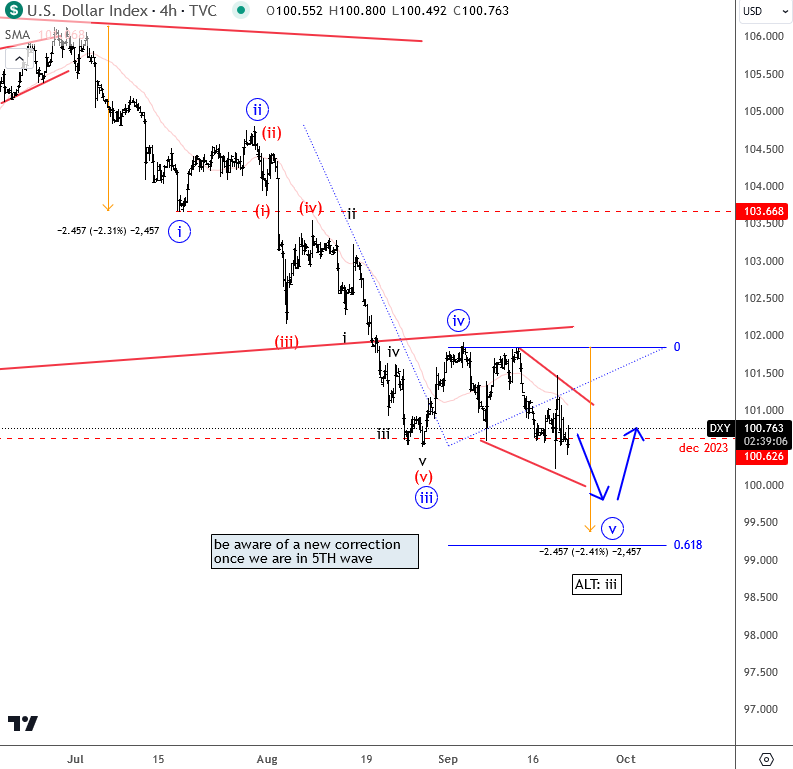

Dollar Index – DXY has turned bearish after the corrective rally stopped at 105.70-106, an important resistance area at the end of June. Since then, the price even accelerated lower through summer so it appears that a bearish impulse is in play, but with recent touch of a new swing low, DXY is possibly in fifth wave, so be aware of some support in weeks ahead. But closer looks shows that there is still some room left for 99.50-100 area, but if this will occur and structure a wedge shape, then we should be aware of reversals, and new corrections.

So as said, the price could still see a bit more weakness into the 5th wave to fully complete this ending diagonal, but then dollar might then stabilize in the next few weeks, especially considering the Fed’s 50 basis point rate cut. Keep in mind that most of the recent dollar weakness has been driven by these rate cut expectations, so now that this cut has been done, the dollar may stabilize due to a “buy the rumor, sell the news” effect. Strong support for the dollar is expected around the 99.50 to 100 area, from where we should be aware of new corrective rally. But only temporary; we think that dollar has room for much more weakness, but can seen some rallies first. Ideally 102 is a strong resistance.

GH

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.