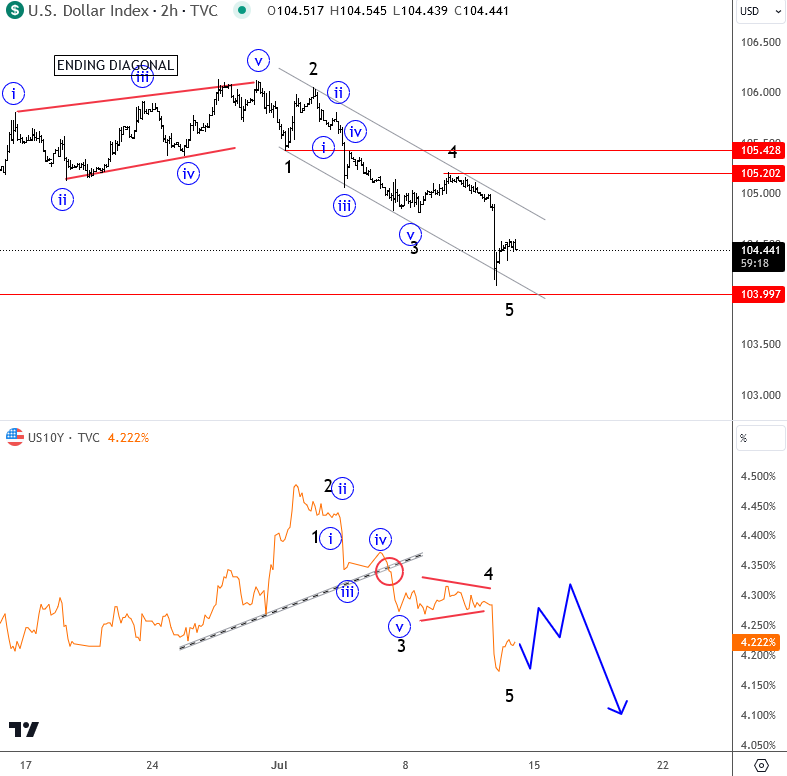

The dollar index experienced a significant sell-off yesterday, after US inflation data has softened more than expected, to 3%, from 3.3% last month. This dollar bearish move across the board was anticipated, and we may continue to expect more weakness if the 104 support is breached.

However, keep in mind that we have five waves down from above 106, so sooner or later, there will be a three-wave counter-trend price movement. In such a case, the 105 to 105.40 area will serve as ideal resistance. Plus, we should also be aware of this potential dollar correction in the near term, considering that US stocks finished lower yesterday after a significant market rotation. So there could be more risk-off sentiment going into next week IF today’s US stock market also finishes lower once we get the release of the US Producer Price Index (PPI) at 2:30 PM CET.

However, any rally on the dollar can be short-lived and part of a bearish cycle while Dollar index is below July highs.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.