It’s interesting that Powell did not bring potential rate cuts to the table, which was widely expected given the risk of recession from the tariffs announced by Trump. But apparently, Powell’s main concern right now is not recession—it’s inflation. He seems to believe that a recession can still be avoided, while inflation could rise further in the coming months due to trade wars. This is likely why the Fed doesn’t want to act too quickly with rate cuts, as doing so could only fuel inflation even more.

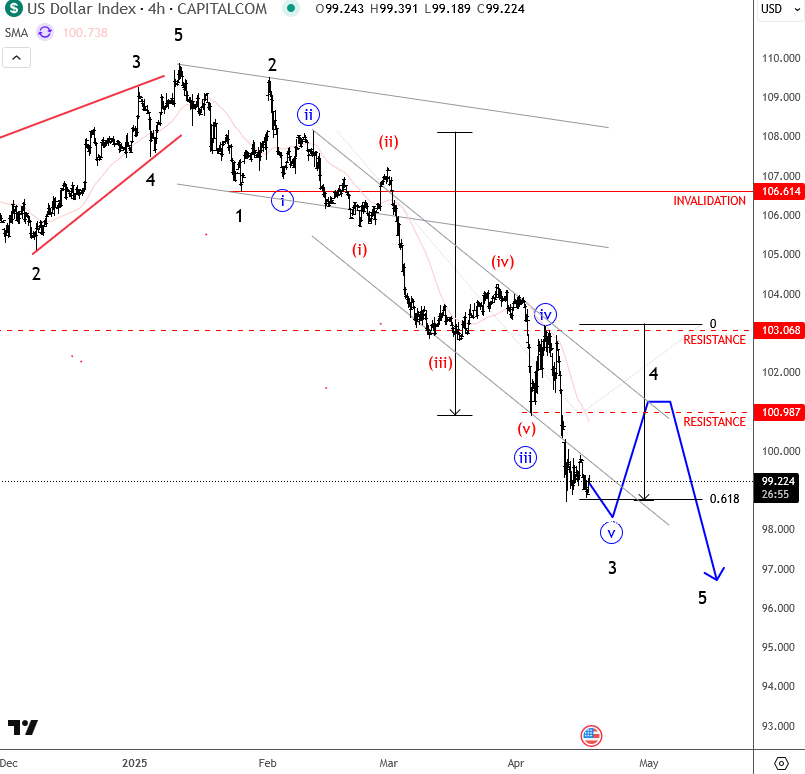

Because of this, the US dollar is sideways and could still see some stabilization in the next few trading days due to the holidays, which usually bring some shifts in flows in the short term. Looking at the 4h price action on the dollar index, its trading at the lows but at the end of an extended wave 3, so there’s a possibility of some correction, maybe next week. Especially if we consider that on one side we have dovish ECB and FED who is not ready to cut yet. So wondering if Dollar rally can come from lowere EURUSD, which is buy a dip for me, but after DXY retraces to 101 which can be some nice resistance up there.

If you are celebrating, I wish you a nice Easter Holidays.

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.