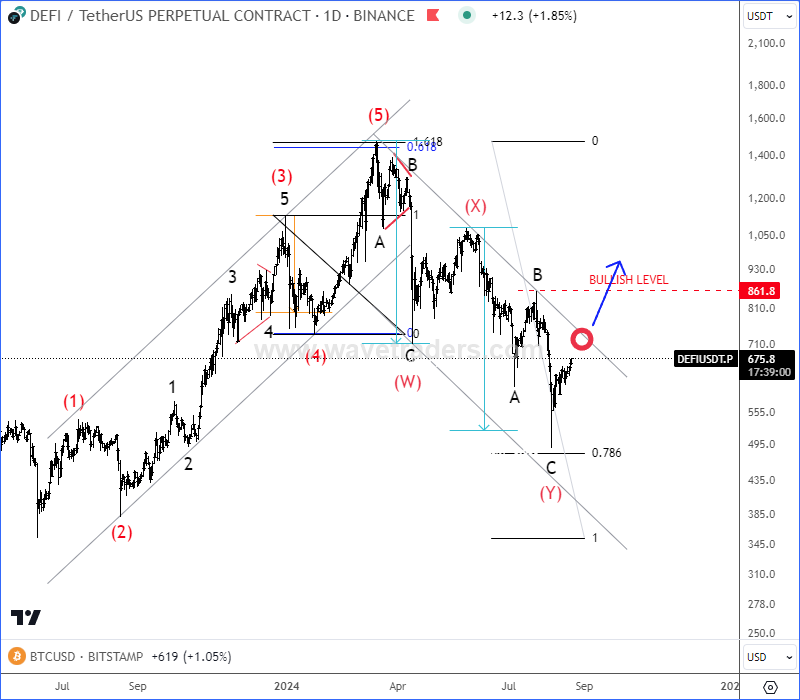

DeFi Index made nice and clean five-wave rally from June of 2023 into March of 2024, which confirms bottom in place, especially if we respect a complex W-X-Y corrective decline since March 2024 highs till August 2024.

It’s actually already bouncing quite strongly away from key 78,6% Fibo. retracement after potentially completed projected complex W-X-Y corrective setback, but to confirm bulls back in the game, we need to see it back above channel resistance line and 861 region.

After recent stock market sell-off due to recession fears, Crypto market slowed down again, but now that risk-on sentiment is back with bullish stocks and bearish USdollar, seems like even Crypto market may stay in the bullish trend, especially if we consider an inflation cool-down and upcoming interest rate cut in US.

For more analysis like this you may want to watch below our recording of a live webinar streamed on Monday August 19 2024