Our members and us, have been updating DAX on a regular daily basis – with some opportunities. One of them was shared 5 days ago, 22nd of October – when we saw the topping formation on DAX on proposed wave.

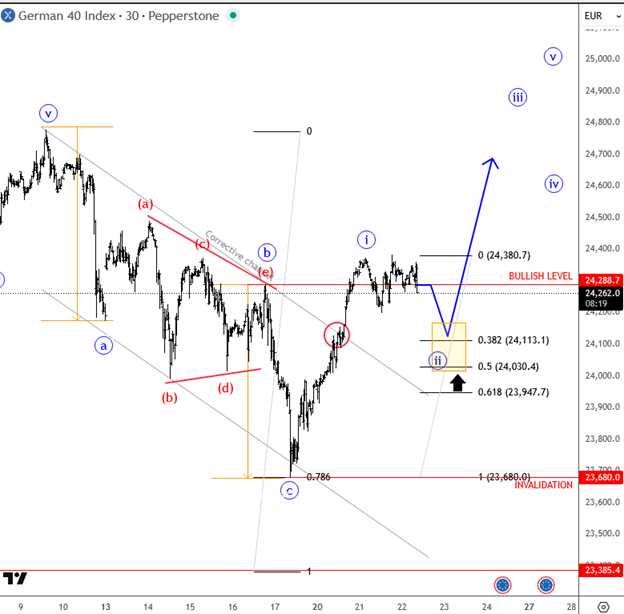

Here is the snippet from the update we sent out:

“It seems the market is forming a pause, ideally wave two within a new ongoing recovery. Even if we see some intraday weakness, watch for support around 24,000 to 24,180, where bulls could step back in. The invalidation level is at 23,680”

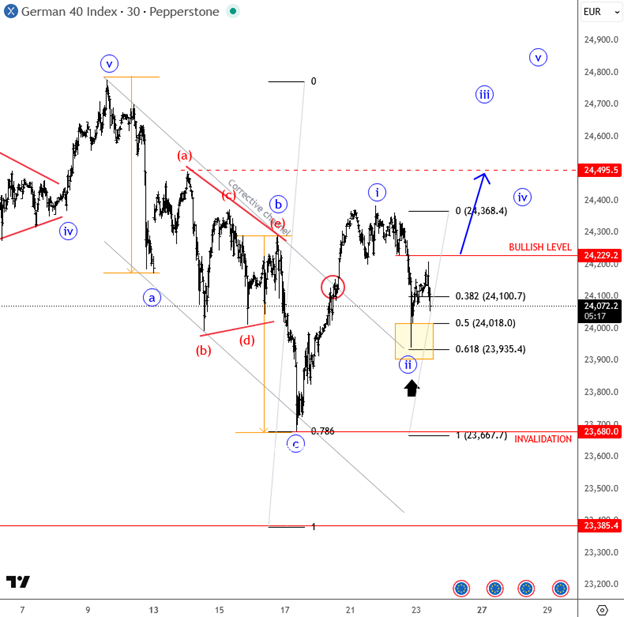

Later, we can see how nicely DAX has progressed to our support level, where we mentioned how important is 24,180 / 24,000. Here is the snippet from our latest update:

“German DAX recovered nicely from last week’s lows, and then made a healthy retracement yesterday, right into the corrective channel support. This suggests there’s a chance that bulls will return and ideally push the index back toward the 24,500 area, especially if we see an overlap with 24,229 today. The invalidation level remains at 23,680”

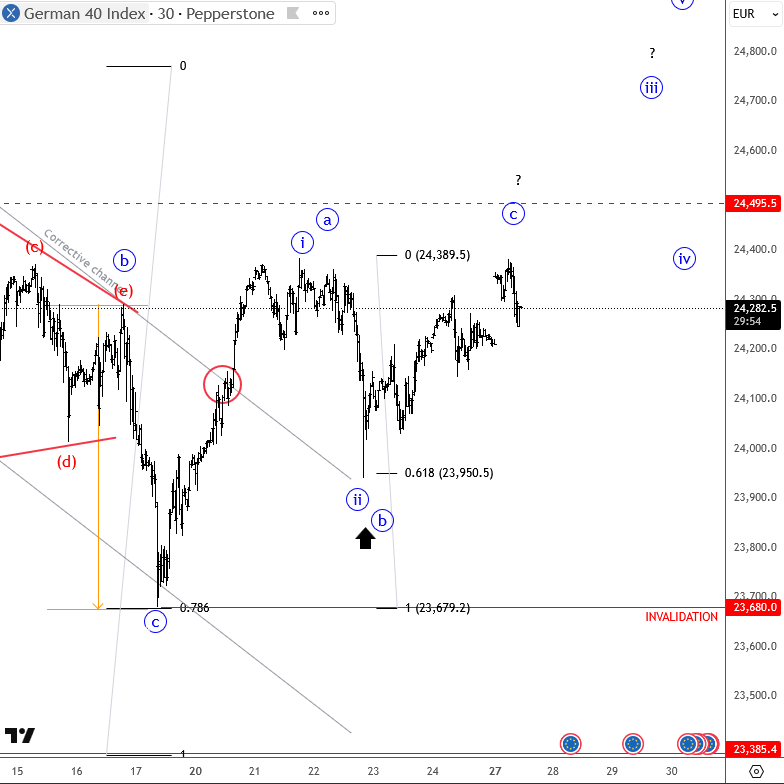

Well, by today, we can see some nice push up on DAX, back to preivous highs as expected. Question is, will uptrend resume? Its up to the market to decide, but for us the mos timportant is to defind and find clear patterns for member, because that’s where opprunites show up.

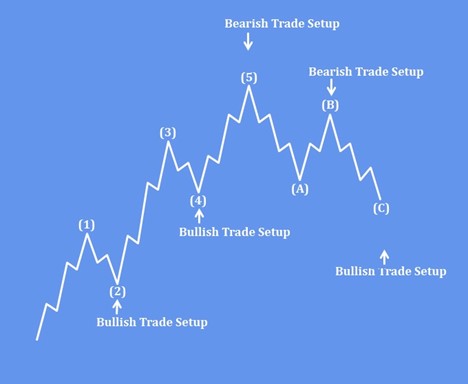

Below, we’ve prepared small educational content about wave 2 retracements, enjoy!

In Elliott Wave theory, Wave 2 is a corrective phase that follows an impulsive Wave 1. It typically retraces part of that first move as the market consolidates gains before resuming the larger trend. Wave 2 corrections often unfold in zigzag or flat structures

Typical Fibonacci retracements for Wave 2:

- 38.2% – shallow correction (strong trend)

- 50%– balanced and most common

- 61.8% – deeper retracement, often ideal before Wave 3 expansion

Check out our resources – https://wavetraders.com/academy

https://x.com/ewforecast – Official X

https://x.com/GregaHorvatFX – Gregas X

https://t.me/EWFTraders – Telegram