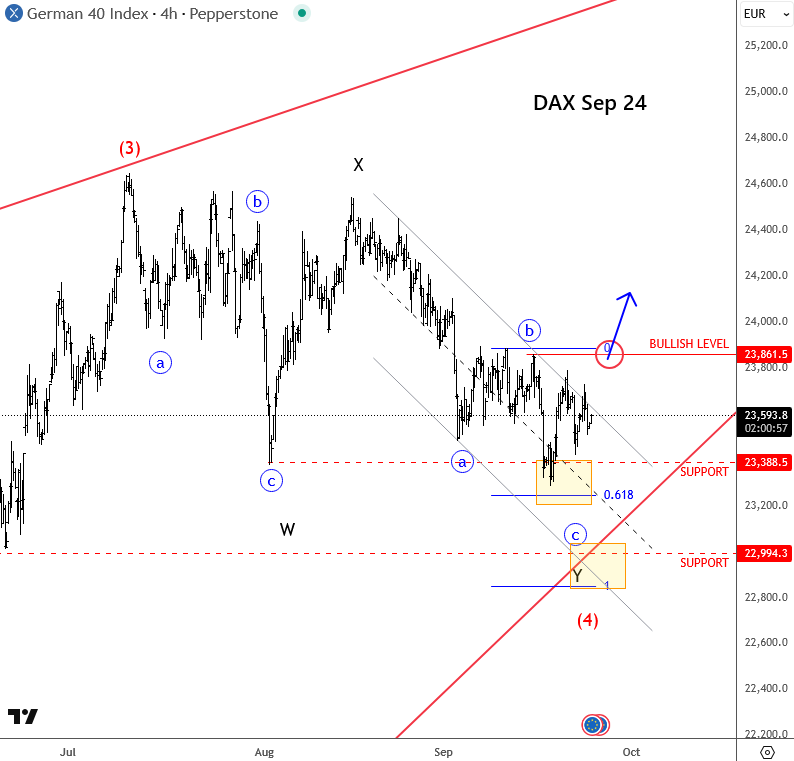

If you are our member, or at least follow our Monday webinars, then you know we talked about a corrective retracement on the German DAX. We successfully identified a complex correction down from the summer high, seeing it as wave four, and warned members that sooner or later the market could push higher. In fact, we specifically noted that the 24K level is a very important breakout zone, and indeed, once the market passed that level, we saw a strong push to new all-time highs.

Now you may be wondering what comes next. On the smaller time frame, DAX is trading at new all-time highs after breaking out of an intraday fourth-wave triangle this week. What’s important to understand is that it looks like we are now in an extended blue wave three, meaning there could be some resistance in the near term, but after the next slowdown, likely a wave four, we would still anticipate more upside. Ideally, the next consolidation will stabilize somewhere around the previous wave four area, near 24270–24400.

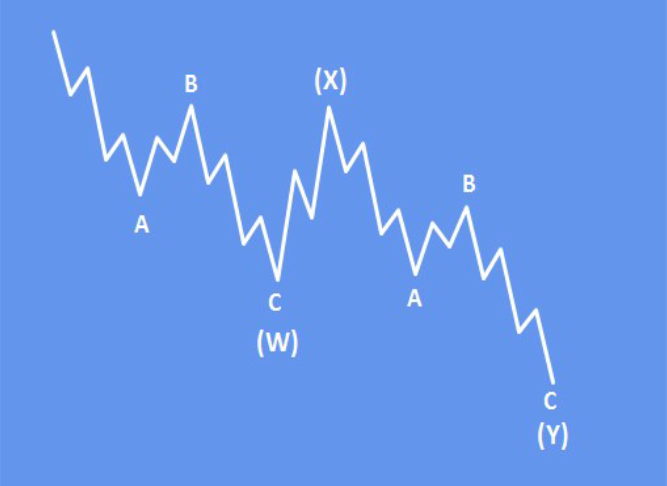

What is complex correction?

W-X-Y is a complex correction, where wave X connects the first part of the correction with the second one. Normally, you will see a lot of overlaps within this structure, and despite the deeper retracements, these moves are usually fully reversed later on.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.