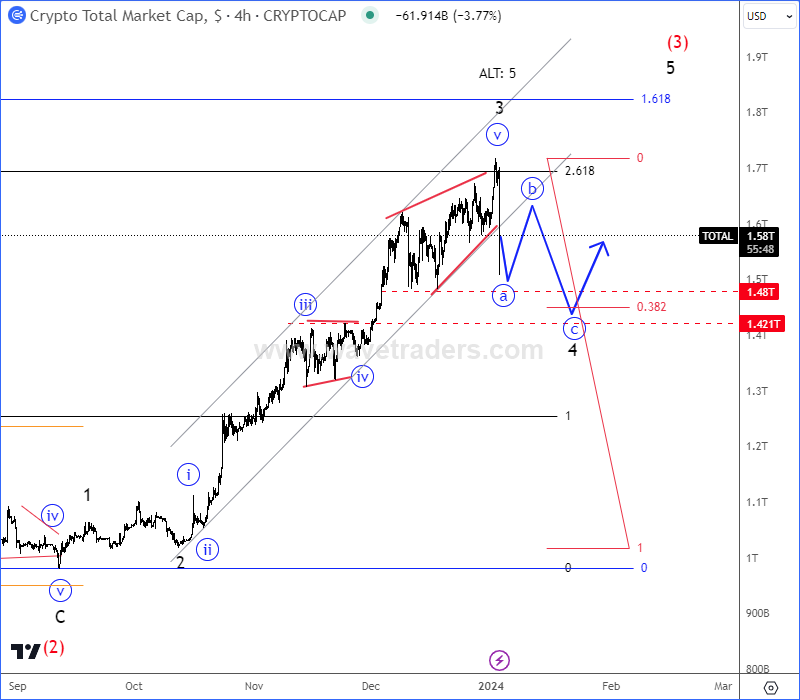

Crypto market turned sharply down after Matrixport’s latest report claims that the SEC will reject all Bitcoin spot ETFs in January, and final approval may be achieved in the Q2. Well, after we spotted the wedge pattern within wave »v« of 3, seems like a higher degree a-b-c corrective slow down can be now in play with 1.5T – 1.4T support zone before a bullish continuation for wave 5.

For detailed view and more analysis like this you may want to check our latest quick video update below:

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

We shared our Elliott Wave Market Outlook for 2024. Check full video analysis HERE.