Crude oil is bearish, and it’s coming nicely lower as expected by Elliott wave theory, even on the intraday basis in the past two weeks, as we will represent below that our members received in paid membership.

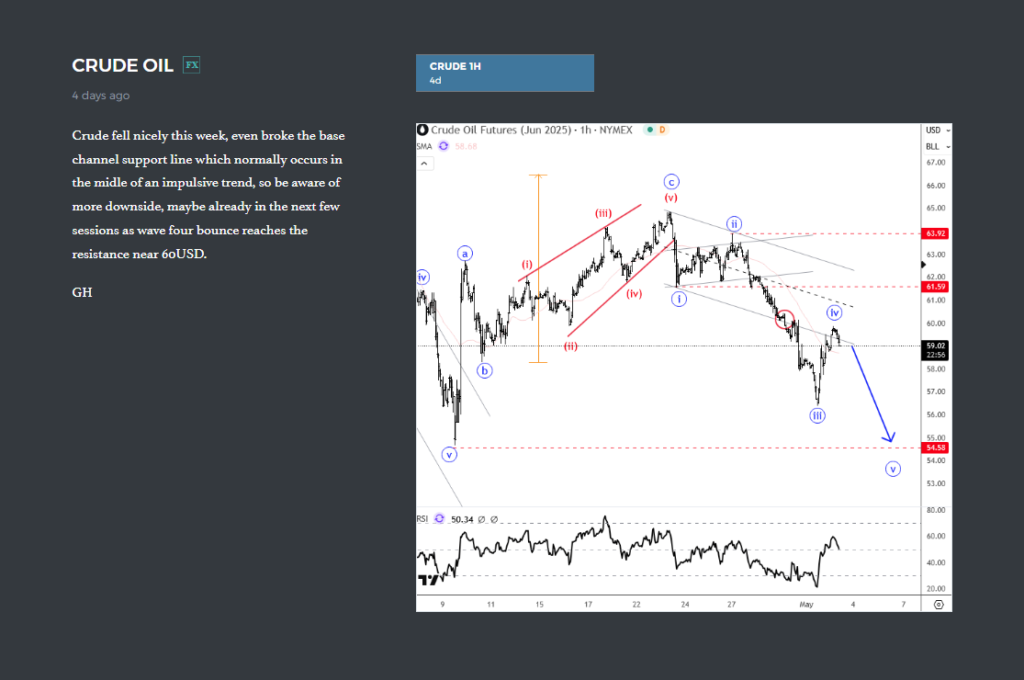

On April 22, we were tracking an a-b-c correction within downtrend, where wave “c” was forming an ending diagonal pattern, so we warned about limited upside and resistance at 66 area for the final subwave (v) of the wedge pattern within “c” before bears show up again.

TIP: Keep in mind that ending diagonals are powerful patterns, so it need special attention by our analysts.

Later on April 25, we got that reversal from projected resistance after a completed ending diagonal a.k.a. wedge pattern within wave “c”, so we pointed out that more weakness is coming after an intraday pullback.

TIP: Top was in place, so more weakness was in view based on this powerful pattern.

On April 29, it made a nice intraday pullback, which we saw it as a bearish setup formation with waves “i” and “ii” that caused a nice bearish set-up.

Later on May 02, it extended nicely lower below base channel support line within a projected wave “iii”, but we mentioned and highlighted that more downside can be seen for wave “v” after a wave “iv”, right into the base channel resistance.

TIP: When base channel is broken in wave three, that same lower line can act as resistance after wave four retracement.

As you can see, on May 05 Crude oil retested the previous intraday lows for wave “v”, which actually confirms the bearish trend, so we can expect more weakness after a corrective pause.

TIP: Elliott wave pattern suggests that market will change a direction when five wave move is nearing the end

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

By today, on May 7th Crude is already back above 59.00. Our members also recenvied a Trading note by our team, based on this clear recognizable wave pattern.