Hello Traders, and welcome to another blog post!

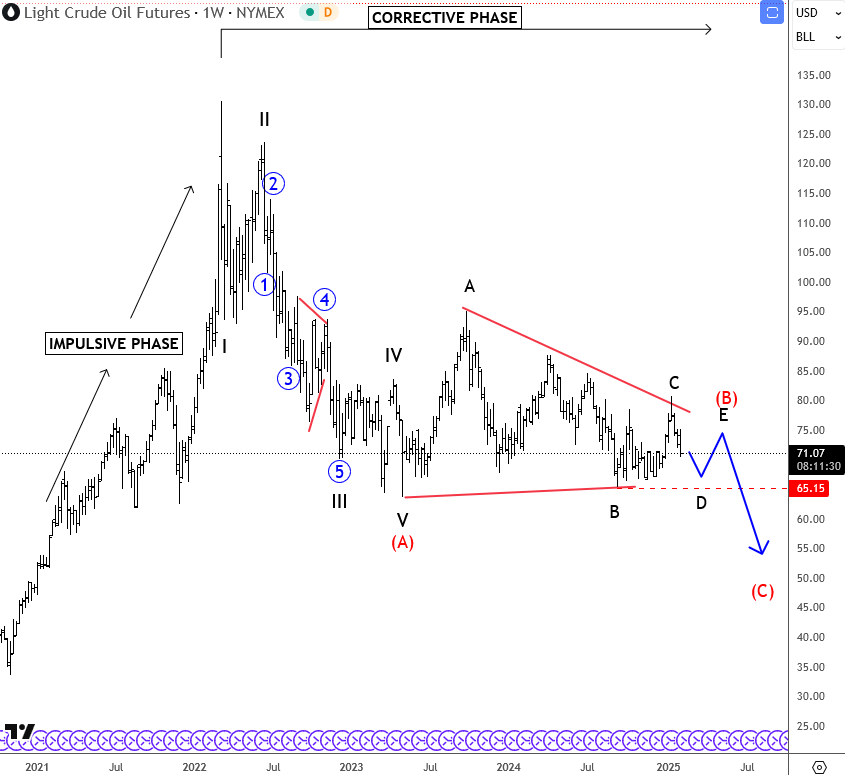

This time, we’re discussing crude oil. If you’ve been following our 2025 free Elliott Wave video outlook (click here), you’ll know we highlighted a bearish pattern. The reason for this is the ongoing sideways consolidation since 2023, which looks like a corrective pattern within a broader downtrend.

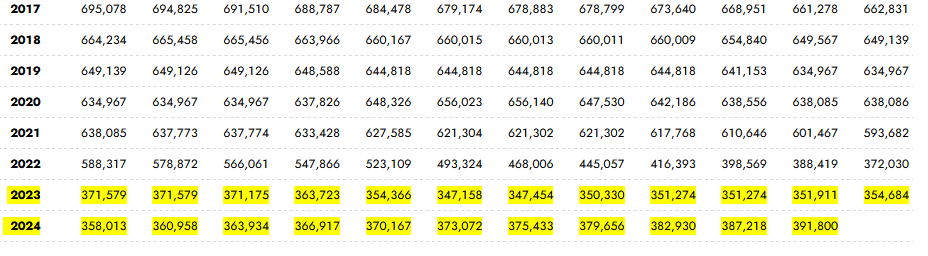

Back in January, we updated our view, mentioning that upside is likely limited. This is partly due to the Trump administration’s goal of bringing crude oil prices lower, with plans to refill the US strategic reserves. In fact data from the Energy Information Administration, showing that production has been gradually increasing since summer of 2023, around the time energy prices hit a swing high near $95. Since then, crude oil has consistently formed lower swing highs.

So, if the Trump administration will really boost the oil production, it will likely put more downward pressure on energy prices and help ease inflation; the CPI y/y data, which is highly correlated with crude oil prices, could decline as well as shown on the chart above (but this will change if / when economy “booms”).

From an Elliott wave perspective, we are tracking an ongoing A-B-C-D-E triangle pattern, but wave E could still push prices a bit higher, for a rally in the next few weeks, because the pattern appears incomplete. But, once this triangle concludes, I expect a break to the downside. This would likely coincide with lower inflation expectations as mentioned; thus lower US yields, and a weaker US dollar.

Overall, my assumption is that crude oil will eventually break below $64 per barrel in 2025!

If you enjoy this analysis and want more updates on crude oil and other key markets, be sure to check our services or join our free webinar on Monday at 15:00 CET. Have a great weekend!

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.