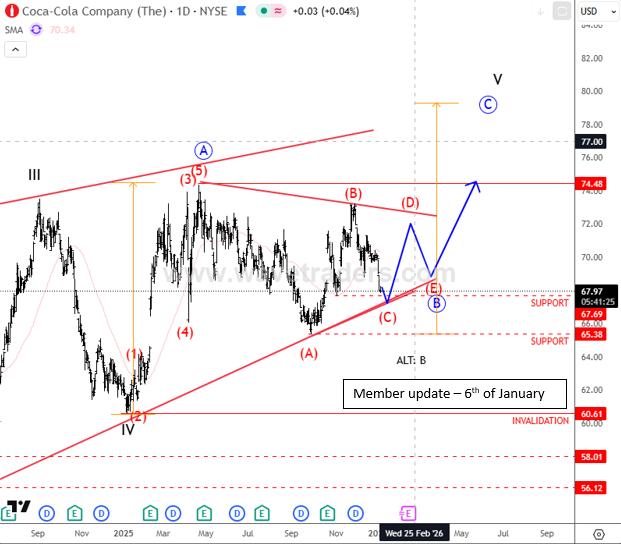

Coca-Cola is breaking sharply to the upside, just as we have been discussing in recent updates, where we highlighted a triangle forming in wave B of wave five. The breakout from this triangle is now accelerating, which is typical behavior, but upside could become limited, as moves out of triangles are often final in a sequence. It’s important to note the strong resistance zone around 79 to 80, where the upper trend line of a wedge pattern is located, as shown on the weekly chart. So bulls could start slowing down there later this year. Generally speaking, and based on the current structure, the higher probability move may already be behind us, so the focus here should be on protecting profits rather than looking for new entries.

The update prior to this move has been sent out on 6th of January, with chart below.

You can enjoy daily analysis like this on Forex, Stocks, Commodities and Crypto in our members area https://wavetraders.com/elliott-wave-plans/

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.