Like what you see here? Sign up to our list and receive these report straight into your email box. CLICK HERE

Philosophers are people who do violence, but have no army at their disposal, and so subjugate the world by locking it into a system.

–Robert Musil

Many analysts are warning the draconian measures taken by the US and other Western nations, especially cutting access to the SWIFT payment system. Represents the beginning of the end of US dollar hegemony. The dollar’s status as the big man on the block has been a concern for a while. We view the latest display of financial nuclear war flowing primarily from the United States as another brick in the wall for the dollar’s long-term decline.

We have shared this before, but it so neatly encapsulates the situation, in one tight paragraph, we share it once again:

America’s rising pressure on its allies threatens to drive them out of the U.S. orbit. For over 75 years they had little practical alternative to U.S. hegemony. But that is now changing. America no longer has the monetary power and seemingly chronic trade and balance-of-payments surplus that enabled it to draw up the world’s trade and investment rules in 1944-45. The threat to U.S. dominance is that China, Russia and Mackinder’s Eurasian World Island heartland are offering better trade and investment opportunities than are available from the United States with its increasingly desperate demand for sacrifices from its NATO and other allies.

Keep in mind, before you rush out and sell all your dollar holdings and invest them into the Chinese yuan. This process of decline for the dollar’s status will be measured in years. Writing in the Financial Times, GaveKal’s Arthur Kroeber:

Finally, efforts to internationalise the conventional, non-digital renminbi over the past decade have stalled. The renminbi accounts for 2.5 per cent of global reserves. Russia, which tried to sanction-proof its economy by shifting its reserves out of dollars, holds just 13 per cent of those reserves in renminbi — less than the euro, gold or even the hated dollar.

The picture in payments is similar. The share of China’s trade settled in renminbi has hovered at around 10-15 per cent since 2016, and the Chinese unit accounts for less than 3 per cent of foreign exchange transactions handled by the Swift messaging system.

The failures of renminbi internationalisation reflect structural problems. The main obstacle is China’s tight capital controls, which it needs in order to keep monetary independence and ensure the stability of its heavily-leveraged domestic financial system.

These controls, combined with the immaturity of China’s bond and money markets, mean that international investors have little incentive or ability to hold large renminbi balances. They rightly fear that such holdings cannot easily be liquidated at any time and in any amount. Until they have such confidence, the use of the renminbi for cross-border payments will remain limited.

Mr. Kroeber is correct. There will be no dollar challengers near-term, but there is little doubt the process has begun.

The unprecedented blitzkrieg of sanctions leveled on Russia from Western nations, effectively cutting the country off from the global financial system. Will do irreparable harm to US control over the financial system as other countries scramble to reduce reserve exposure. And judging by China’s reaction to US moves and threats is move evidence the US unipolar status is no more.

Viewponion Magazine recent interview (by Issac Chontiner) of John Mearsheimer. A realist foreign policy expert, and a man who understands how the world really works, adds weight to the view US unipolarity is history. We share a few choice excerpts below, you can read the interview in its entirety here. (our emphasis):

Isaac Chotiner: Of course we did, but I’m wondering if we should be behaving that way. When we’re thinking about foreign policies, should we be thinking about trying to create a world where neither the U.S. nor Russia is behaving that way?

JOHN MEARSHEIMER: That’s not the way the world works. When you try to create a world that looks like that, you end up with the disastrous policies that the United States pursued during the unipolar moment. We [United States] went around the world trying to create liberal democracies. Our main focus, of course, was in the greater Middle East, and you know how well that worked out. Not very well.

Isaac Chotiner: I went back and I reread your article about the Israel lobby in the London Review of Books, from 2006. You were talking about the Palestinian issue, and you said something that I very much agree with, which is: “There is a moral dimension here as well. Thanks to the lobby of the United States it has become the de facto enabler of Israeli occupation in the occupied territories, making it complicit in the crimes perpetrated against the Palestinians.” I was cheered to read that because I know you think of yourself as a tough, crusty old guy who doesn’t talk about morality, but it seemed to me you were suggesting that there was a moral dimension here. I’m curious what you think, if any, of the moral dimension to what’s going on in Ukraine right now.

JOHN MEARSHEIMER: …But in the real world, that is not feasible. The Ukrainians have a vested interest in paying serious attention to what the Russians want from them. They run a grave risk if they alienate the Russians in a fundamental way. If Russia thinks that Ukraine presents an existential threat to Russia because it is aligning with the United States and its West European allies, this is going to cause an enormous amount of damage to Ukraine. That of course is exactly what’s happening now. So my argument is: the strategically wise strategy for Ukraine is to break off its close relations with the West, especially with the United States, and try to accommodate the Russians. If there had been no decision to move Nato eastward to include Ukraine, Crimea and the Donbass would be part of Ukraine today, and there would be no war in Ukraine.

… I’m talking about the raw-power potential of Russia—the amount of economic might it has. Military might is built on economic might. You need an economic foundation to build a really powerful military. To go out and conquer countries like Ukraine and the Baltic states and to re-create the former Soviet Union or re-create the former Soviet Empire in Eastern Europe would require a massive army, and that would require an economic foundation that contemporary Russia does not come close to having. There is no reason to fear that Russia is going to be a regional hegemony in Europe. Russia is not a serious threat to the United States. We [the United States] do face a serious threat in the international system. We face a peer competitor. And that’s China. Our policy in Eastern Europe is undermining our ability to deal with the most dangerous threat that we face today.

China is smiling.

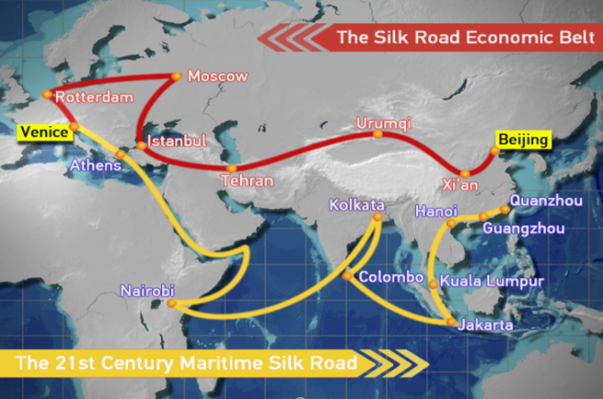

Before we get to the latest headlines supporting the idea of growing potential crisis for the dollar, let’s take a look at China’s strategic geo-political positioning as defined by the extremely prescient Mackinder (taken from Robert Kaplan’s article from 2010: The Geography of Chinese Power):

The English geographer Sir Halford Mackinder ended his famous 1904 article, “The Geographical Pivot of History,” with a disturbing reference to China. After explaining why Eurasia was the geostrategic fulcrum of world power, he posited that the Chinese, should they expand their power well beyond their borders, “might constitute the yellow peril to the world’s freedom just because they would add an oceanic frontage to the resources of the great continent, an advantage as yet denied to the Russian tenant of the pivot region.”

Leaving aside the sentiment’s racism, which was common for the era, as well as the hysterics sparked by the rise of a non-Western power at any time, Mackinder had a point: whereas Russia, that other Eurasian giant, basically was, and is still, a land power with an oceanic front blocked by ice, China, owing to a 9,000-mile temperate coastline with many good natural harbors, is both a land power and a sea power. (Mackinder actually feared that China might one day conquer Russia.)

China’s virtual reach extends from Central Asia, with all its mineral and hydrocarbon wealth, to the main shipping lanes of the Pacific Ocean. Later, in Democratic Ideals and Reality, Mackinder predicted that along with the United States and the United Kingdom, China would eventually guide the world by “building for a quarter of humanity a new civilization, neither quite Eastern nor quite Western.”

Any so-called foreign policy expert should know all about Mackinder’s views. But, once again, it seems the word competency should rarely used in the same sentence with US foreign policy.

On the economic front, the dogs of hybrid war bark while the Eurasia integration caravan marches on – with the Empire irretrievably being pushed outside of the Eurasian landmass.

In a phone call prior to the Lavrov-Kuleba meeting in Antalya, President Erdogan suggested to Putin setting up a trading mechanism in gold and also rubles, yuan and Turkish lira to beat the Western sanction hysteria. The source is Abdulkadir Selvi, very close to Erdogan. No Russia-China official comment yet.

The key fact is that Russia, China, and for that matter the entire Shanghai Cooperation Organization (SCO) – responsible for at least 30% of global GDP and the bulk of the Eurasian market – don’t need the West at all.

As Peter Koenig, a former senior economist at the World Bank points out, “Western GDP has a different basis, with blown out of proportion services. Whereas the GDP of the SCO and the Global South is production-based. A huge difference when one looks at the backing of currencies: in the West there is literally none. Eastern currencies are mostly backed by national economies, especially in China and soon in Russia too. That leads to self-sufficiency, and no longer reliance on the West.”

In sum: it’s an all-out war on Eurasia integration.

–Pepe Escobar, Cutting Through the Fog Masking ‘a New Page in the Art of War

So, in yet another stroke of brilliance from President Joe Biden and his team. We hear the US is going to start putting the screws to China if they don’t get on-board the Russian sanction train.

Chen Feng, writing in the Asian Times, From Russia, will the US expand economic war to China?:

- China does not support Russia’s war, but it also continues to maintain normal trade ties with Russia, and Sino-Russian trade will likely increase sharply. Not only by absorbing large amounts of oil and gas and wheat imports from Russia, but also by significantly increasing exports of consumer goods and industrial technology to Russia to compensate for the decline in Russia’s trade relations with the West.

- China does not need to bypass sanctions when the United States has made high-profile threats against it. These are only sanctions based on US domestic law. Not United Nations Security Council sanctions. The transportation of goods between Russia and China does not have to go through other countries, or only through friendly countries.

- China is a sovereign state, and the US has no right or power to order China to comply with US sanctions against Russia based on domestic law. Nor can the US push sanctions against Russia through the UN Security Council.

- Inflationary pressure in the US also comes from the return of the over-issued dollar. The excess dollar issuance comes from the dollar’s hegemony as a settlement currency in world trade, which has decoupled from the size of the US domestic economy. Now that China and Russia are shifting to the euro and yuan for energy and general trade and Saudi Arabia has begun accepting Chinese payments for oil exports in yuan. This will lead to a massive return of over-issued dollars to the US, further increasing inflationary pressures in the US.

- While the de-dollarization of trade between China and Russia is not a surprise. Saudi Arabia’s move is a breakthrough. The Saudi-led Middle Eastern oil exporters agreed to use the US dollar as their oil settlement currency. The most significant move to anchor the US dollar since Nixon abolished the dollar-gold standard. Making the “non-standard” dollar the “oil standard” dollar and thus the benchmark settlement currency for world trade.

- The massive shift of Russian oil to China due to the European and US embargoes, coupled with Saudi Arabia’s switch to RMB settlement. May force more and more countries exporting oil to China to switch to RMB settlement. The situation brings to mind the old saying. “I don’t have to run faster than the bear – I just have to run faster than the next fellow.”

- China is the world’s manufacturer, and even a mass shift to RMB settlement for bilateral trade involving China would massively crowd out the circulation of the dollar. Leading to a return of over-issued dollars and creating some over-issuance for the RMB. China could also greatly reduce its foreign exchange reserves and sell off a large amount of US debt to free up funds. All of which would create a perfect storm for the dollar.

- If the United States and Europe declare. “If China does not follow through with sanctions, then sanction China,” do they then have to sanction the whole world? Are the United States and Europe encircling all the countries they don’t like, or are they isolating themselves from the world?

Granted. The view from Mr. Chen may be a bit biased toward China. However, it does layout the global case for a significant decline in dollar reserve holdings over time as countries increasingly lose confidence in the US ability to lead.

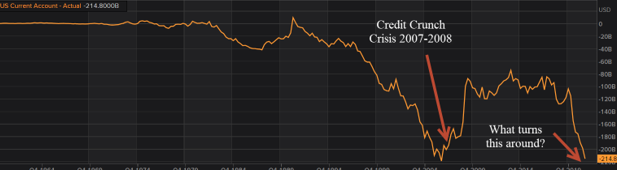

A decline in the demand for US dollars is especially bad news for a country which now produces most of its wealth on the back of financialization, not the real economy. In fact, the US real economy position (production and sale of real goods and services) continues to deteriorate against the world and especially against China. A look as the US current account deficit makes that perfectly clear.

Current Account as defined by Investopedia:

- The current account represents a country’s imports and exports of goods and services, payments made to foreign investors, and transfers such as foreign aid.

- The current account may be positive (a surplus) or negative (a deficit); positive means the country is a net exporter and negative means it is a net importer of goods and services.

- A country’s current account balance, whether positive or negative, will be equal but opposite to its capital account balance.

Notice above, highlighted red. Think of the capital account as demand for US dollars (and assorted financial assets); given the US inability to manufacture. A hit to the dollar makes its global financial position vis-a-vie the rest of the world that much riskier.

US Current Account 1964 thru 2021: Heading for a new low?

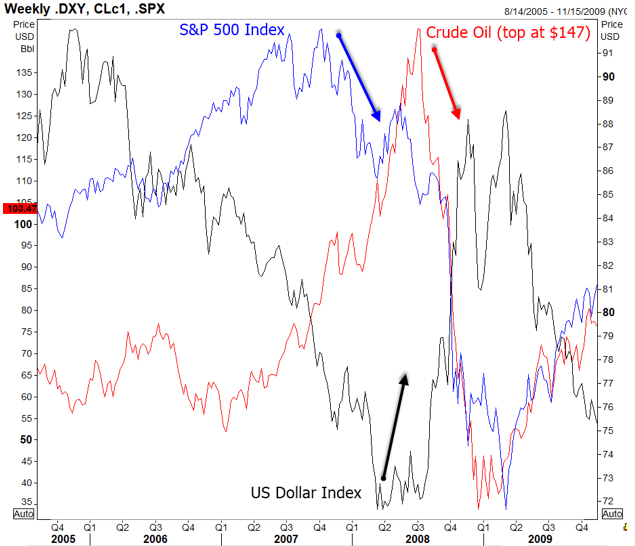

Because the US dollar is still at the core of the system, we expect one more major risk-bid in the dollar. Possibly carrying it to fresh new highs, similar to what we saw back in 2007-2008 as the current crisis evolves.

Déjà vu all over again? Dollar up, stocks down, oil & commodities hammered as everyone runs for the exits? It could be.

Dollar Index (black), US Stocks (Blue), Oil (Red) Weekly 2005-2009:

We suspect the US Fed is warming up its swap lines now. This in itself sets up an interesting dynamic: raising interest rates and providing global liquidity as the world scrambles of dollars and inflation rises.

Don’t let your babies grow up to be central bankers comes to mind.

The shape of the world will be drastically changed after the next crisis hits. And if we are right, it won’t be nearly as friendly to the United States and the dollar as it once was.

We end this missive with these words from Professor Barry Eichengreen’s excellent book. Exorbitant Privilege: The Rise and Fall of the Dollar and the Future of the International Monetary System:

Concern with the consequences of the dollar losing its exorbitant privilege is not limited to the pocketbook. A weaker dollar, security specialists warn, will make it more difficult for the United States to project strategic influence and pursue foreign policy goals. Maintaining a foreign military presence will become more expensive. We will have less foreign aid money with which to win friends and influence people. American companies will be less able to make the strategic investments in, inter alia, West African oil refineries that cause countries anxious to our capital to take note of our preferences. Devalued dollars will be less capable of buying the cooperation of foreign governments.

Other countries with stronger currencies meanwhile will be doing all the things that we can no longer afford.

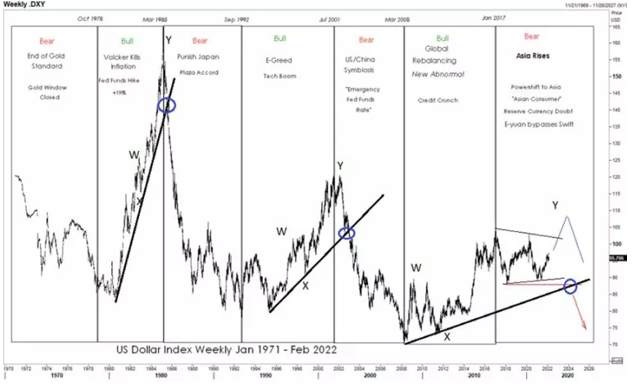

The Technical Look

USD

Technically the USD long-term trend remains the same; likely bearish after the cycle from 2008 is complete. Now still moving complex. We talked about this one here

USDCNH

Corrective rise from 2014 low and broken trendline suggests more weakness in months ahead.

SILVER

Remember during uncertain times, volatile markets with military actions. People will always try to look for “real staff”, like commodities and metals. One of metal where we see good upside potential in months ahead can be SILVER. We see room for 35-40USD.

Stay tuned. And be careful out there.

If you like what you see here, you can learn more about us, and subscribe to our service at our website. We also have live customer chat support to serve you.

Regards,

Gregor and Team…

If you like what you see here, and would like our Macro Views sent directly to your mailbox Free. Just click on link below and register.