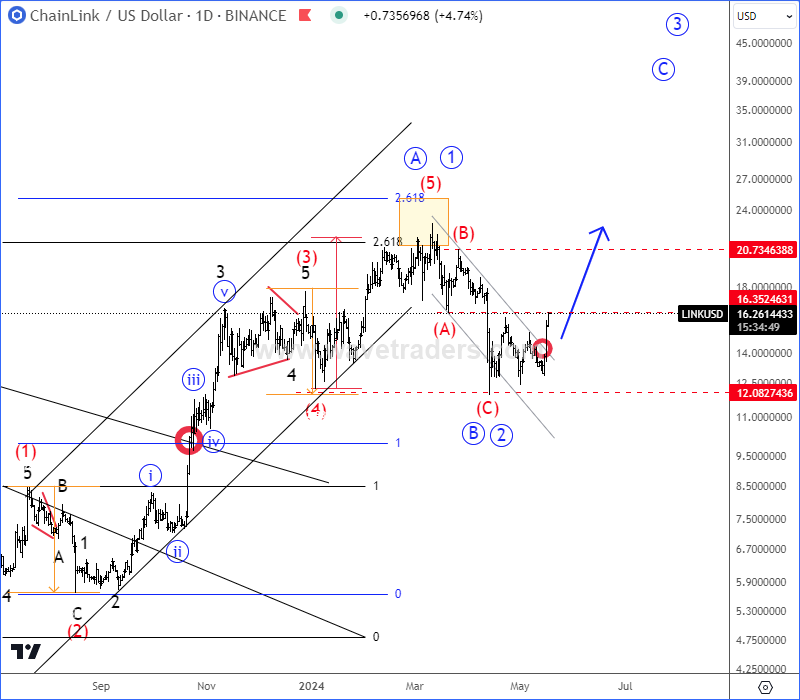

ChainLink May Have Formed A Higher Degree Bullish Setup, as we see nice and clean five waves up from the lows, followed by an A-B-C corrective setback.

We have been talking a lot about bullish ChainLink with ticker LINKUSD. We also shared a free chart on January 26, where we mentioned and highlighted an ongoing five-wave bullish cycle from the lows. CLICK HERE

As you can see, LINKUSD has nicely unfolded five waves up from the lows, which is actually first higher degree leg A/1 of larger minimum three-wave A/1-B/2-C/3 rally. After completing five waves up into wave A/1, we have seen a higher degree slow down recently, which we believe it’s just an A-B-C correction within wave B/2 before a continuation higher for wave C or 3.

LINKUSD is already nicely recovering away from projected 12 support area as Chainlink races toward tokenization of funds. It’s coming back above channel resistance line after a three-wave A-B-C correction in B/2, so wave C or 3 can be actually already underway, especially if breaks above 20 bullish confirmation level.

Chainlink (LINK) is a decentralized oracle network that seeks to connect smart contracts on the blockchain with real-world applications. Launched in 2017, Chainlink’s goal is to provide smart contracts with data feeds, allowing them to interact with external systems. The network is supported by a diverse community of data providers, node operators, and smart contract developers. Chainlink’s approach aims to integrate off-chain data into smart contracts, positioning it within the data processing field. The network also provides opportunities for users to become node operators, contributing to the network’s infrastructure and receiving compensation in return.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

China Stocks Are Extending A Recovery. Check our free chart HERE.