Several yen crosses are turning down from key resistance levels that we’ve been tracking for weeks, or even months. While market movements often require a catalyst—whether risk-off sentiment or hawkish central bank commentary—it’s crucial not to rely solely on news and events. Instead, focus on key technical levels, price personality, correlations and the Elliott wave pattern.

Looking back, we saw a strong decline in yen crosses during the summer of 2024, coinciding with pullback stocks. Now, as US stock markets recover near all-time highs, yen crosses have also seen some recovery, but this rebound appears weak and more like a counter-trend movement that may not go back to 2024 levels anytime soon.

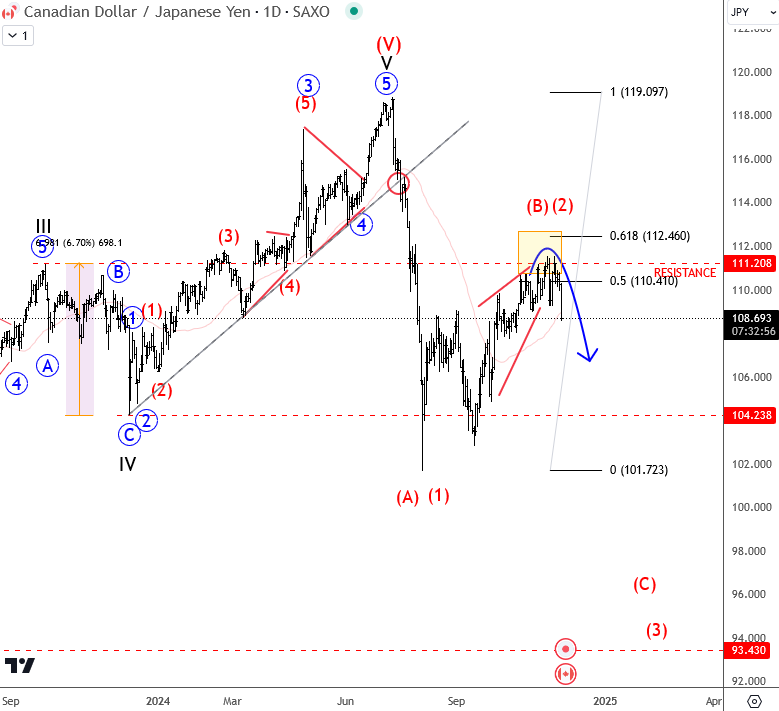

In fact, we’re CADJPY turning down nicely from the 111.20 resistance level, which may mark a potential top for wave B or wave 2. Further downside seems likely then, particularly as a sell-off could accelerate following Trump’s announcement of potential new tariffs on Canadian imports. This would likely weaken the Canadian dollar further.

On the other side, the Bank of Japan (BOJ) might consider another rate hike or express concerns over the weak yen, which has lost significant strength over the past two months, especially against the US dollar. These dynamics could intensify selling pressure on CADJPY, especially if at teh same time we see some risk-off moves.

From an Elliott wave perspective, the rise on CADJPY from August appears to be a three-wave correction, suggesting that more weakness is likely sooner or later.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.