Bullish SP500 Can Be Supportive For NZDUSD from technical point of view and from Elliott wave perspective.

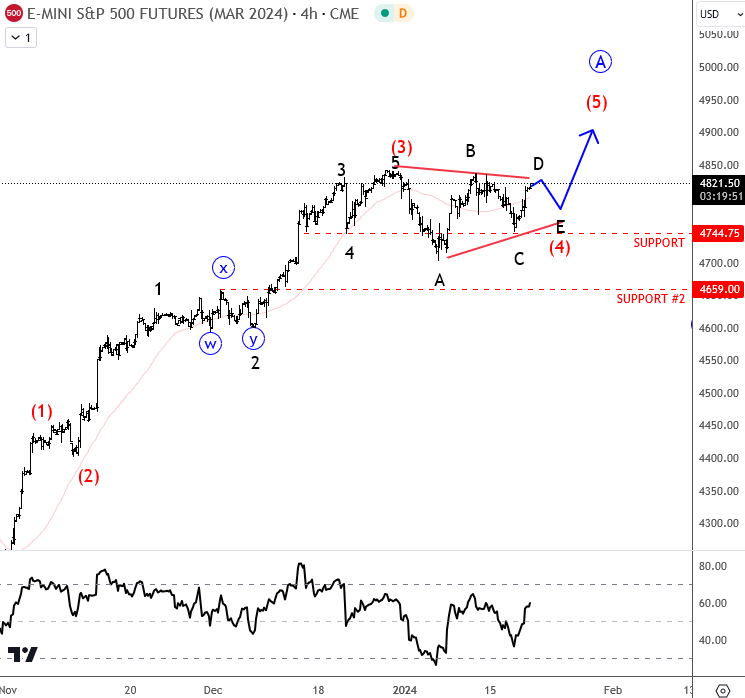

SP500 came higher through November and December of 2023, and appears that bulls can stay here with the current intraday impulsive structure. We see ongoing five-wave recovery with more upside in view after corrective wave (4) is finished, which can be a bit more complex. However, we spotted some support still at 4700, from where prices recovered nicely, but it can still be part of a correction, possibly of a triangle based on latest price developments.

Kiwi with ticker NZDUSD is still weak despite higher stocks, but looking at Kiwi, it can be trading in late stages of a wave C, so possibly even this one will find new buyers if stocks will continue to rise today and finish the week strong. Then we think even Kiwi could see some nice bullish reversal, but to make sure that pair is bottoming, of-course we would need rally back above 0.6180/0.62.

Become a premium member

Get daily Elliott Wave updates for SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

NZDUSD Made A Corrective Setback As Expected. Check our free chart HERE.