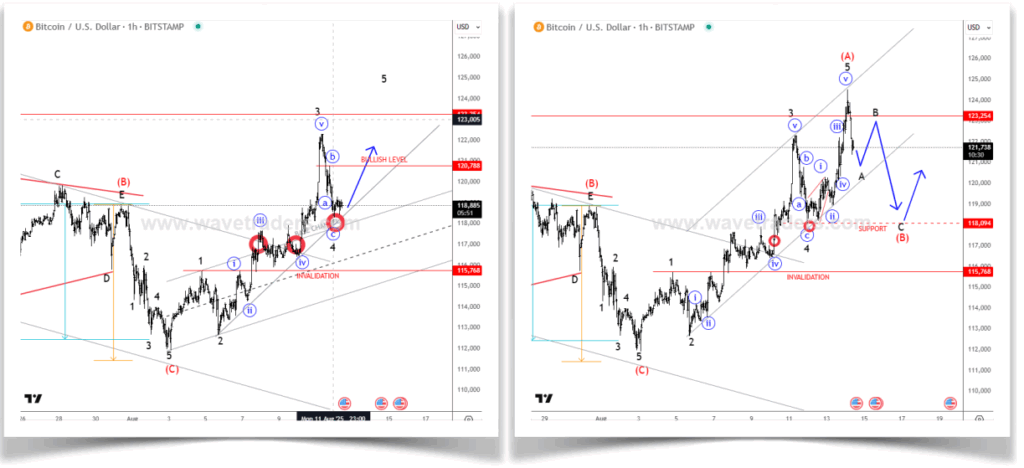

BTCUSD made a quite sharp and big intraday drop 12th of August, but it’s still in three legs abc, which we highlighted and labeled it as higher degree wave 4 correction that belonged to bullish impulse. Back then we saw bitcoin testing an interesting support at the upper base channel line. And we have made our members aware of further rally within wave 5 back to highs.

Long and behold, after couple trading sessions, BTCUSD hit fresh new all-time highs as expected, and retraced most of the price action, which is normally the case when five wave move is finished!

So far, Bitcoin has corrected 7.37% percent or 9.1k notional value of USD. This could be a very important key support for the week, especially if we consider the possibility of a wedge pattern forming within a potential wave C. A reversal could certainly happen in the next few sessions, even if just temporary for a three-wave rise, while the price holds above the 112K area. For more prices analysis and potential move in the next few sessions, make sure to check our services, and discover what our analysts think about bitcoin.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.