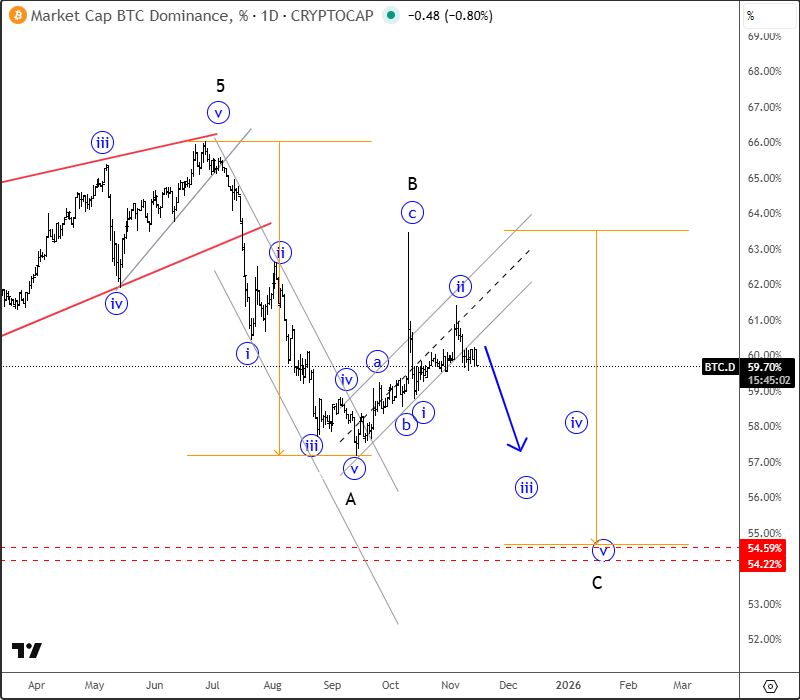

Good morning Crypto traders! Crypto market is coming lower along with technology stocks, but mainly because of weak Bitcoin, as Bitcoin dominance keeps falling with space for much more weakness, so ALTcoins are holding up much better at the moment. However, to prevent further weakness on ALTcoins, we need to see stabilization and recovery on Bitcoin, which could be possible today at the end of the week, especially if technology stocks find a base as well.

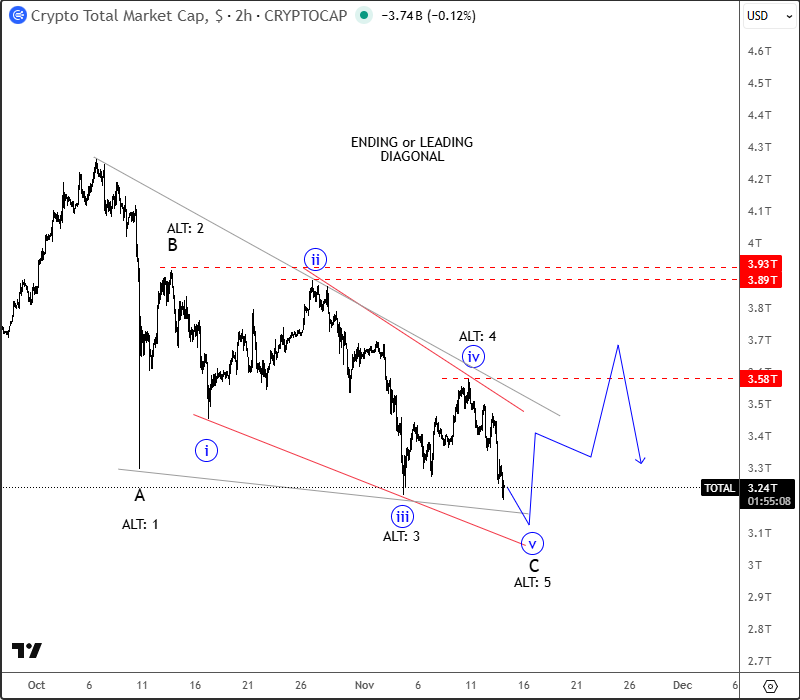

Crypto TOTAL market cap chart is coming lower on the intraday basis, but notice that it can be either finishing wave 5 of a leading diagonal formation from the highs, or subwave “v” of the wedge pattern within wave C of an ABC correction. In both cases, be aware of a recovery in a minimum of three waves soon, ideally from around 3.0T area.

Bitcoin dropped below 100k level, which more and more looks like a top formation with the wedge pattern on a daily chart, especially now that Bitcoin dominance is back to bearish mode. Currently, it looks to be now forming and potentially finishing a leading diagonal pattern from the highs, so be aware of stabilization and a new higher degree corrective recovery before a continuation lower later this year or in 2026.

It’s important to keep an eye on technology stocks like Nvidia, which has been slowing down alongside Bitcoin due to their positive correlation. For Bitcoin to stabilize and begin recovering, Nvidia will likely need to find support as well.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.