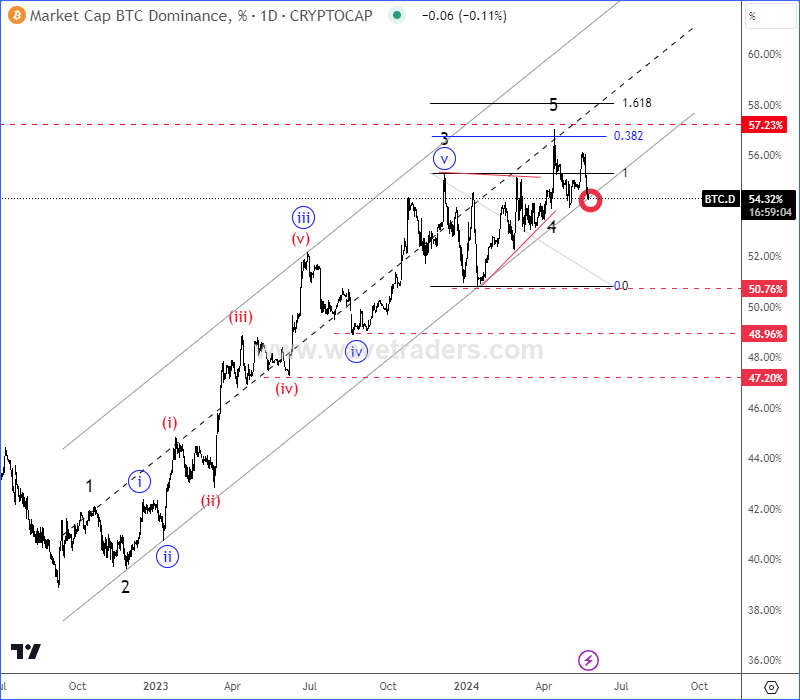

Bitcoin dominance is slowing down, but in the bullish Crypto market, this can be just positive for ALTcoins from Elliott wave perspective.

We have been talking a lot about dominance in the Crypto market in the last couple of months. We also shared a free chart of Bitcoin.dominance back on March 12, where we mentioned and highlighted final 5th wave of an impulse. CLICK HERE

As you can see today, Bitcoin dominance is now on the verge of a break below channel support line after a completed projected wave 5 of a five-wave bullish cycle. Well, Bitcoin dominance can slow down all the way back to 50% – 45% support area, but in the current bullish Crypto market as shared two days ago, this could be just positive for the ALTcoins. We shared a blog about ALTseason back on April 16. CLICK HERE

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Potential ECB Cut And UK CPI Data Can Cause Drop On EURGBP Out Of An Elliott Wave Triangle.

Check article HERE