Bank of America is reversing sharply to the downside since the start of the year, with price gapping through the lower trendline support. The move accelerated after President Trump imposed a 10% cap on credit card loans, which triggered a sharp reversal from the all time highs. This price action suggests that we could see much more weakness ahead. If the ending diagonal is indeed complete, then any rebound toward the previously unfilled gap around 54.50 could turn into an attractive resistance zone for the next sell off, potentially targeting the 50 area on the downside.

We’ve added educational post at the end about ending diagonals, enjoy! For daily analysis like this, join us here

On the bigger picture, the stock is running into serious resistance after moving above the 2006 highs. This does not necessarily mean an immediate multi year downtrend, but higher time frame resistance combined with an ending diagonal on the daily chart is clearly a reason for caution.

Highlights:

・Sharp reversal from all time highs signals trend exhaustion

・Gap through lower trendline support confirms downside pressure

・Resistance zone on rebounds near the unfilled gap around 54.50

・Downside risk toward the 50 area if weakness resumes

Educational post:

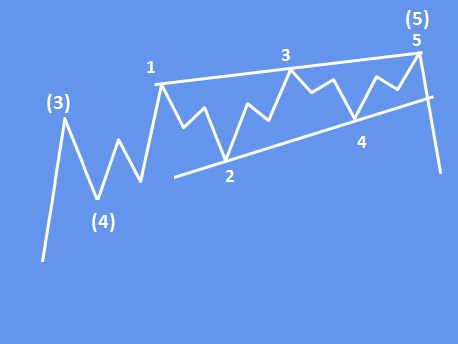

Ending Diagonal — Quick Summary but for detailed study, visit our course area

What it is

- Terminal Elliott Wave pattern that appears at the end of a trend

- Usually forms in Wave 5 of an impulse or Wave C of an A–B–C correction

- Signals trend exhaustion and often precedes a sharp reversal

Structural rules

- Consists of five waves (1–2–3–4–5)

- All waves subdivide into threes

- Wave 4 overlaps Wave 1

- Price action forms a contracting wedge

Typical behavior

- Momentum weakens even as price makes new highs or lows

- Wave 5 often accelerates, trapping late entrants

- After completion, price usually reverses sharply, often retracing the whole pattern

Key Fibonacci relationships:

Wave 5 failures are common and strengthen reversal signals

Wave 3 ≈ 61.8% or 100% of Wave 1

Wave 5 ≈ 61.8% of Wave 3, or sometimes equals Wave 1

Post-completion retracement typically 61.8%–78.6% of the entire diagonal

Wave 4 retraces 38.2%–61.8% of Wave 3

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.