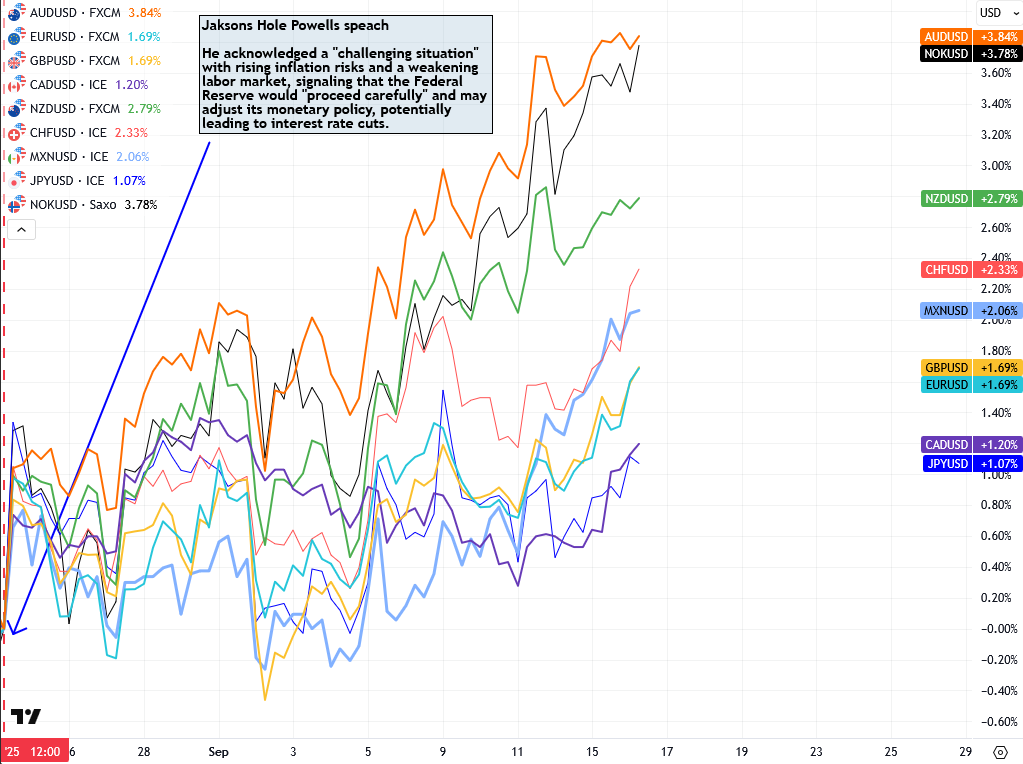

Dollar has been weakening, in particular since August 22nd when Powell spoke at Jackson Hole, acknowledged rising inflation risks, and more importantly, weakening labor data. Back then he signaled that the Fed could adjust rates with a 25 or possibly even a 50 basis point cut this Wednesday.

Looking at FX pairs, what stands out to me is that we are clearly in risk-on mode, with commodity currencies doing very well since late August. Aussie is up almost 4% from the August 22nd lows, while ther majors are lagging behind that performance. So it may not be a bad idea to focus on Aussie for potential longs versus the US dollar, especially considering inflation in Australia increased on a yearly basis from 1.9% in June to 2.8% in July, as reported on August 27th. This shows inflation is still a problem in Australia, so the RBA may not be looking to cut rates, which makes AUDUSD attractive on the upside.

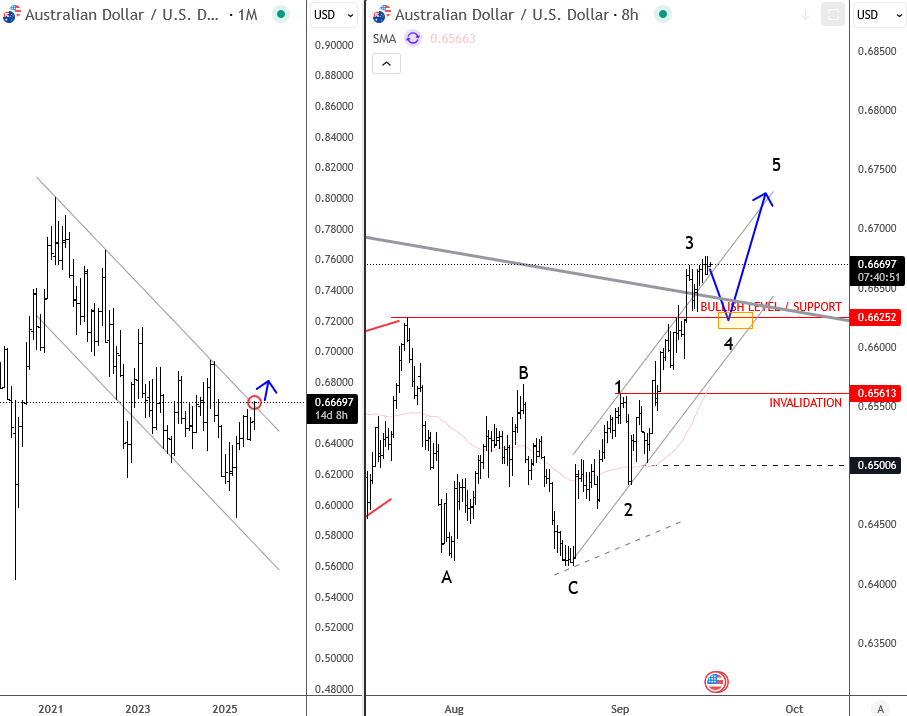

From an Elliott Wave perspective, I also like the impulsive characteristics on Aussie from the August 22nd close. In my view, we are still in an incomplete five-wave cycle, with the recent push beyond the July highs being wave three. After the next pullback in wave four, there could be a strong rebound, with the 0.6625 level standing out as attractive support on dips. I’ll certainly keep a close eye on this zone if a retracement occurs.It’s also worth noting that Aussie is now trying to break the trendline from the 2021 highs, which could be an interesting breakout point and support the recovery, at least until the five-wave cycle completes on the 8-hour chart.

Grega

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.