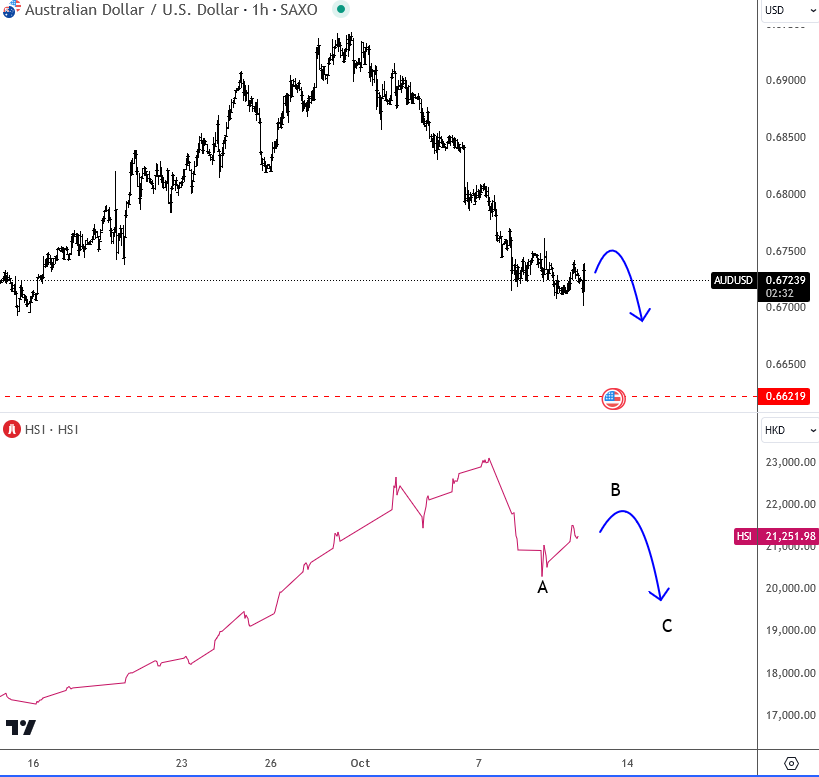

If you’re trading the Aussie, it’s crucial to keep an eye on China. China has shown a strong recovery at the start of the month, but now Chinese shares seem to be facing near-term weakness as I’m seeing a retracement that should be structured by three waves on Hang Seng Index – HSI. Even if this is just a temporary setback, there’s still room for more weakness after a wave B rally. This also suggests that the Aussie could see more downside. Rather than focusing on AUD/USD, I’m more interested in AUD/JPY, which could experience a more significant and aggressive sell-off if this risk-off sentiment from China spreads to the US.

Keep in mind that inflation didn’t fall to 2.3%, but rather came in at 2.4%. This could mean that speculators expect fewer rate cuts from the Fed, and if that’s the case, it may limit the upside on stocks. Consequently, yen crosses, including AUD/JPY, could experience notable reversals to the downside.

Looking at the 4-hour timeframe, there’s a clear ABC rally up to the 101 level, which appears to be strong resistance. Be prepared for a potential sell-off in the next few days or weeks. If we see a drop towards 97 and a break through the lower trendline support, much more downside could be on the way for AUD/JPY.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.