Apple (AAPL) remains one of the world’s most valuable companies, driven by strong iPhone sales, a growing services segment, and consistent innovation in hardware and software.

Apple has shown a strong move to the upside since our last stock update, with the price still trading within an extended blue wave three-cycle. It’s now testing resistance around 260, the high from December 2024, which could lead to some short-term consolidation. However, any pullback should be viewed as an opportunity to rejoin the trend, with the first support at 241, followed by 227. These are key zones to watch for a potential rebound. The invalidation level is at 214 — as long as this level holds, the trend remains bullish.

Highlights:

- Trend: Bullish (extended wave three)

- Support: 241, 227

- Resistance: 260

Note: Watching the pullback zone for continuation higher

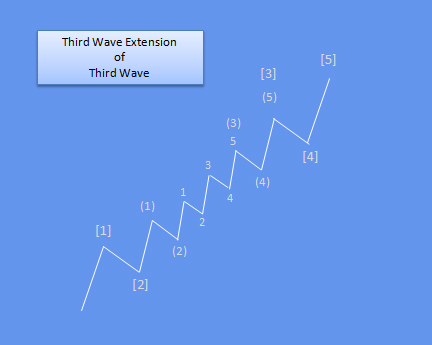

A Bullish Impulse Wave in Elliott Wave Theory is a five-wave pattern (1–2–3–4–5) that moves in the direction of an overall uptrend. Waves 1, 3, and 5 advance upward, while 2 and 4 are corrective pullbacks. Key rules include: Wave 2 never retraces beyond Wave 1’s start, Wave 3 is never the shortest, and Wave 4 doesn’t overlap Wave 1’s territory. Wave 3 is typically the strongest, driven by rising momentum and participation. Fibonacci ratios often guide the wave relationships, with Wave 3 commonly extending 1.618× Wave 1. After a bullish impulse, the market usually enters a corrective A–B–C phase before continuing or reversing the trend.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.