Apple (AAPL) remains one of the world’s most valuable companies, driven by strong iPhone sales, a growing services segment, and consistent innovation in hardware and software.

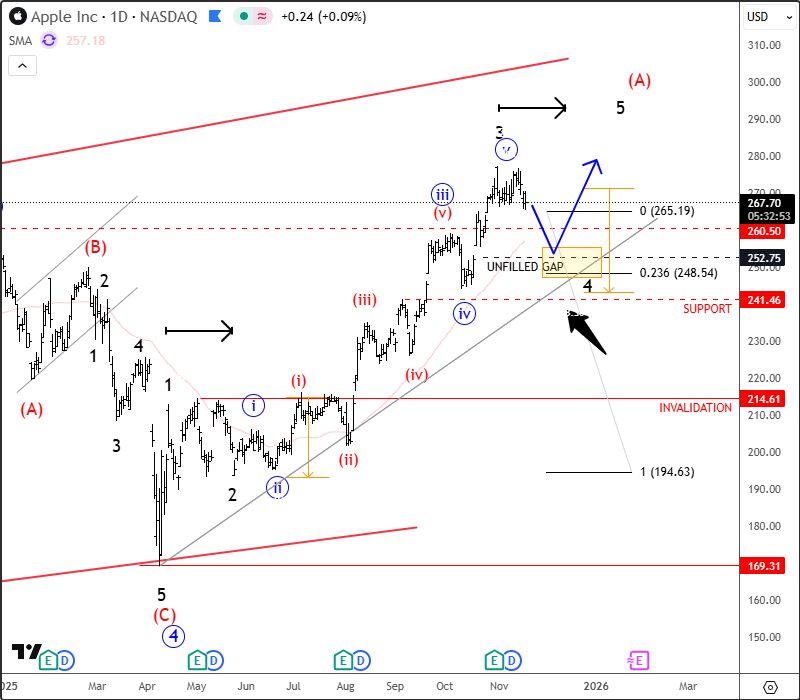

We shared Apple already back on October 16, where we talked about it’s on the way back to all-time highs within an impulsive five-wave rally. CLICK HERE

As you can see by today, Apple hit all-time highs, but an uptrend may not be over yet. Infact price is showing a clear impulsive structure that still supports the broader uptrend. However, it looks like black wave three on the daily chart may be finshed, so a near-term pullback would be natural and healthy before the next bullish leg shows up. Any deeper retracement could provide a new opportunity to join the trend IMO, with the previous fourth-wave zone around 244–251 offering an attractive support area while the market stays above 214, the key invalidation level. Also, notice that [b]252 is a gap[/b] from the latest earnings release, so it certainly can be an interesting zone for completion of a next retracement.

Highlights:

Trend: Bullish (wave three nearing completion)

Support: 244–251

Resistance: 300

Invalidation: 214

Note: Watch for more gains after wave 4, nice support at 252 gap

US Single Stocks Service

Get Elliott Wave US Single Stock updates for some big names and companies