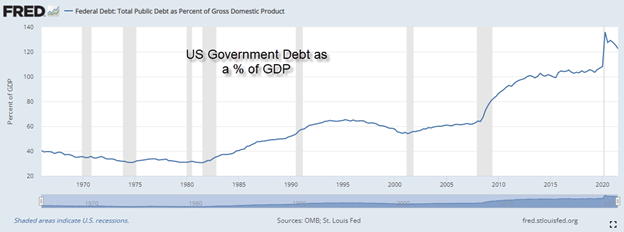

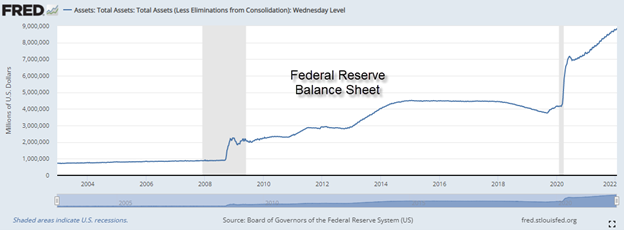

Global Capital would never allow a comprehensive public debate about the toxic role of the financial system – which has been kept under artificial respiration since 2008. With central banks unleashing storms of helicopter money, inflating real estate markets, stocks, precious metal prices. In real life, what’s nearly inevitable next in the horizon is the bursting of a massive stock and real estate bubble all across the West.

Pepe Escobar

The action we’ve seen this year in the stock market suggests a major risk-bid may be in the offing; if so, it will upset a bunch of existing expectations and key asset market trends.

From a global macro stand point, the problem continues to be an inability of the authorities to stimulate the real economy. Governments and central banks continue to create more and more credit:

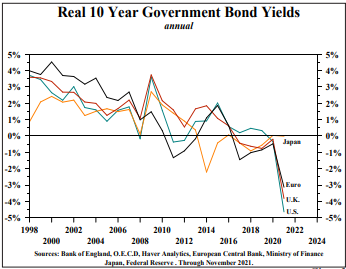

… pushing real yields deeply into negative territory, believing it will help stimulate real growth.

They are wrong!

From Hoisington Investment Research:

A negative real yield points to the fact that investors or entrepreneurs cannot earn a real return sufficient to cover risks. Accordingly, the funds for physical investment will fall and productivity gains will erode which undermines growth. Attempting to counter this fact, central banks expand liquidity but the inability of firms to profitably invest causes the velocity of money to fall but the additional liquidity boosts financial assets.

Now despite being wrong about how to stimulate the real economy, the authorities—the US Fed—sure do know how to stimulate financial assets and creating what Jeremy Grantham calls the biggest multi-asset bubble in history.

This time last year it looked like we might have a standard bubble with resulting standard pain for the economy. But during the year, the bubble advanced to the category of super bubble. One of only three in modern times in U.S. equities, and the potential pain has increased accordingly. Even more dangerously for all of us. The equity bubble, which last year was already accompanied by extreme low interest rates and high bond prices, has now been joined by a bubble in housing and an incipient bubble in commodities.

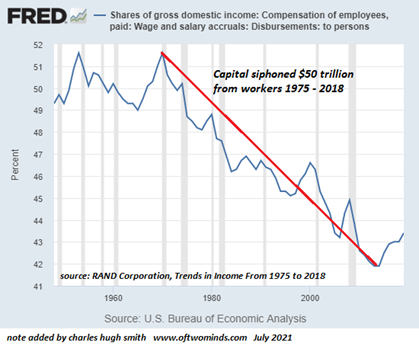

For those with access to capital, it’s been a great run. But for the average guy person, who relies on his labor for income, it’s been pretty ugly for a while. Shutting down the global economy, for a pandemic with a 99.7% survival rate, hasn’t helped.

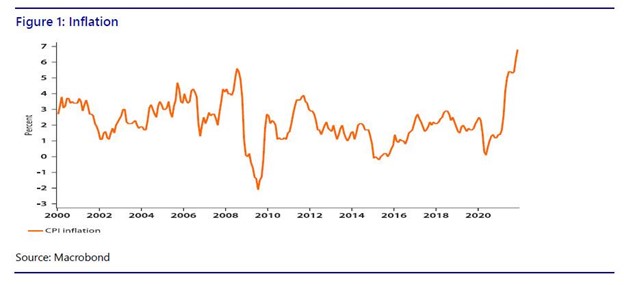

So why is this distorted game likely to change? Inflation!

Even though unemployment fell in 2021, consumers became more alarmed by the drop in real wages according to surveys. The faster inflation shredded the budgets of about 75% of our households. In November, the level of real per capita disposable income equaled the year ago level which was also the lowest level since March of 2020. Consistently, The University of Michigan indicates consumer sentiment in the fourth quarter was worse than during the height of the 2020 pandemic and at the levels of the beginning of the very deep 2008-09 recession.

Hoisington Investment Research

Mr. Consumer is pulling in his horns and corporate earnings are being hammered by rising prices and supply chain problems.

…the diffusion index for prices paid by manufacturers remained at its highest level on record. A diffusion index measures change, not levels, and it means that costs are still rising – no surprise with oil at the highest level in seven years.

Manufacturing, to be sure, is just 12% of the US economy; services represent 78%. And prices paid by service providers as of December were rising at the fastest rate since the Institute for Supply Management’s records bean in 1997.

So, we are seeing a slowdown in economies globally—China is suffering a popping of its own real estate bubble (and impact of debt overhang) and doesn’t look likely to be a driver of global growth anytime soon. Not good for corporate earnings.

Thus, E of P/E (Price-to-earnings) ratio for stocks is falling, while the cost of capital is rising—as central banks tighten credit to stem inflation; it should be no surprise if P follows E; i.e., stock prices go lower from here. And if stocks do go lower, it’s a negative feed-back loop into the real economy for the first time since 2020 and will exacerbate the pressures from inflation on the economy.

We now run the risk of reality to be self-reinforcing to the downside for stocks and the economy.

The plunge in stocks on Thursday had a feeling of slight panic. We suspect this may be only the beginning of something big.

So, if a major risk bid is shaping up, the best bets are as follows:

- Short Stocks

- Long the US dollar and Japanese yen (usually gets a bid on capital repatriation back into the Japanese government bond market.

- Long bonds (capital flow on a run out of risk assets, at least near-term, will likely trump central bank interest rate expectations)

- Short commodities

We provide specific Elliott Wave targets for all the asset classes mentioned above for Members of our service.

Take care. And be careful out there.

If you like what you see here, you can learn more about us, and subscribe to our service at our website. We also have live customer chat support to serve you.

Regards,

Gregor and Team…

If you like what you see here, and would like our Macro Views sent directly to your mailbox, free, just click on link below and register.