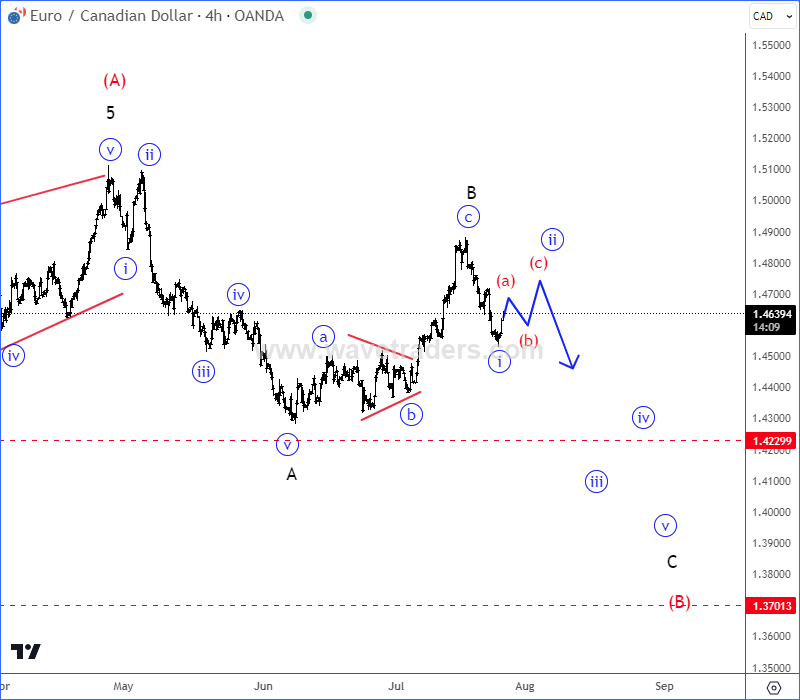

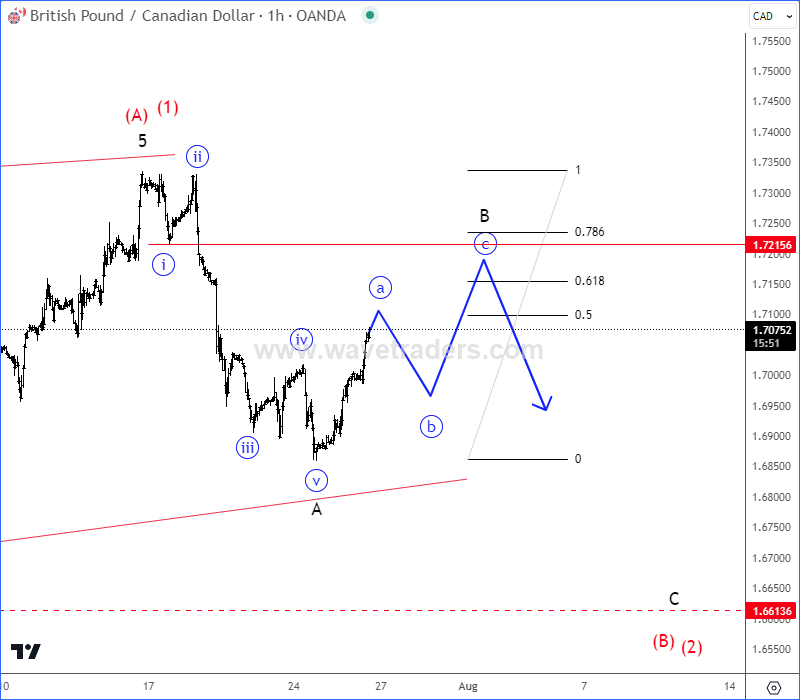

EURCAD and GBPCAD pairs are in higher degree corrections, as we see them turning down with short-term bearish setup formations by Elliott wave theory.

EURCAD and GBPCAD pairs turned sharply and impulsively down in May/June, which was first leg A of a three-wave higher degree A-B-C corrective slow down, which indicates for more weakness for wave C after a corrective recovery in wave B.

After we spotted a five-wave bearish impulse into wave A, followed by a three-wave a-b-c correction in B on EURCAD pair, we can now see it nicely turning back to bearish mode for wave C, which should be completed by a five-wave bearish cycle of the lower degree. Currently we can see it forming a lower degree bearish setup formation with sharp and impulsive turn down into subwave »i«, so watch out for a bearish resumption once a short-term three-wave a-b-c pullback in subwave »ii« fully unfolds.

GBPCAD is trading nicely as expected after we noticed a temporary top for a higher degree wave (A)/(1). With recent five-wave intraday bearish reversal, which we see it as a first leg A, it could be now in a three-wave a-b-c corrective recovery within wave B that can retest 1.72 resistance area before wave C occurs.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Commodities Are Waking Up From The Support as expected. Check our free chart HERE.