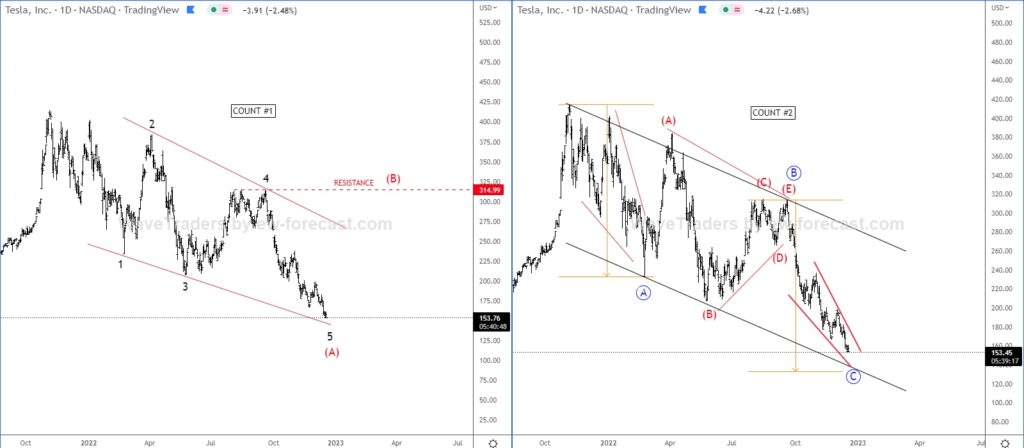

Tesla is approaching interesting support, based on two different interpretations from Elliott wave perspective.

Tesla is currently one of the weakest single stock, but looking at the daily wave structure we can see it approaching interesting support based on two different interpretations. As a primary count it can be unfolding a leading diagonal into wave (A) from the highs, now finishing final subwave 5 that can stop at the lower red line. As a secondary count, there’s a chance that Tesla is already finishing an A-B-C correction from the highs, now in final stages of wave C. Well, the beauty of analysis is when you have two different counts, but both indicate in the same direction, so be aware of bounce and recovery at least in three waves soon, ideally in 2023.

Regarding positive correlation, check also our latest article about Bitcoin HERE