GBPJPY forms the top, as we see it finishing and breaking the wedge pattern from Elliott wave perspective.

GBPJPY was bullish for the last two years, but after reaching strong 170 resistance area within final wave (5) of C of B, seems like it’s forming the top within the wedge pattern.

Looking at the 4-hour, specifically this final 5th wave of C of B, we can clearly see a bullish price action, but the wave structure is getting overlapped, which means that bulls are running out of steam, ideally within an ending diagonal formation a.k.a. wedge pattern.

As you can see, GBPJPY pair is already breaking the lower wedge line and seems like it’s forming the top. However, to confirm bears back in the game, we need to see sharp or impulsive drop back beneath 164.84 level.

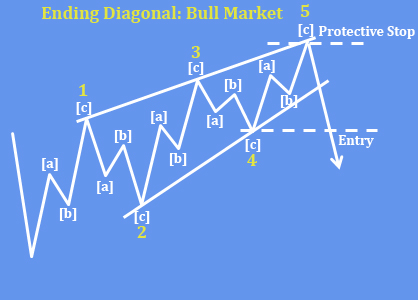

The ending diagonal (wedge) pattern is a special type of wave that occurs in wave 5 of an impulse. An ending diagonal pattern is a type of pattern that can occur at the completion of a strong move. It reflects a “calming” of the market sentiment such that price still moves generally in the direction of the larger move, but not strongly enough to produce an impulsive wave. Ending diagonals consist of five waves, labeled 1-2-3-4-5, where each wave subdivides into three legs. Waves 1 and 4 overlap in price, while wave 3 can not be the shortest amongst waves 1, 3 and 5.

The reason why they are so interesting is because they are indicating a reversal, usually a strong one.