DAX is waking up, making higher highs and higher swing low which is a bullish trend since March low, so we can expect more upside after any retracement since this is wave A, still only the first leg of a higher degree Elliott wave A-B-C recovery. We can actually see a completed Elliott wave five wave cycle within first leg A in the 4-hour chart so looks like Elliott wave correction in wave B has just started. That said, an upcoming A-B-C setback can retest 14000 – 13500 support area .

Also, keep in mind that if ECB turns out to be more hawkish and if we will not get any positive news out from the Ukraine-Russia situation then DAX can be easily come down into wave C of an Elliott wave pattern.

Grega

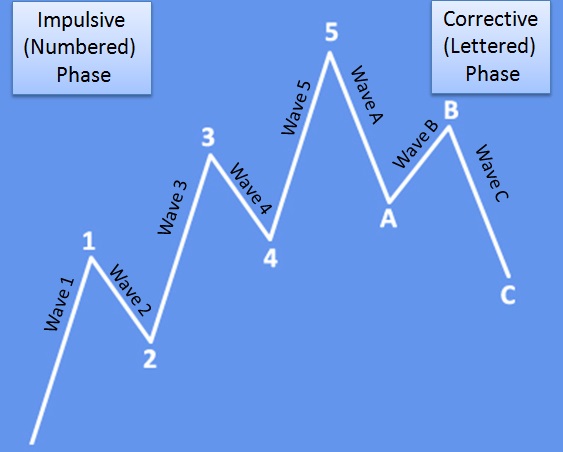

Elliott Wave Cycle

An Elliott wave cycle is an eight-wave pattern with five waves up showing the direction of a trend, while a three-wave setback shows a pullback. This is a temporary pullback that can stop at one of the former swing supports, and must not go beyond the starting point of wave 1.