The Russia-Ukraine conflict remains the main driver of the risk-off sentiment. With stocks coming sharply down in Europe, while crude oil moves to 2008 levels. Bloomberg reported that the US was looking to ban Russian oil imports, which could lift prices even higher. This should have a strong impact on inflation as well then so FED will have to hurry up with higher rates, but they of course will be careful due to war in Ukraine.

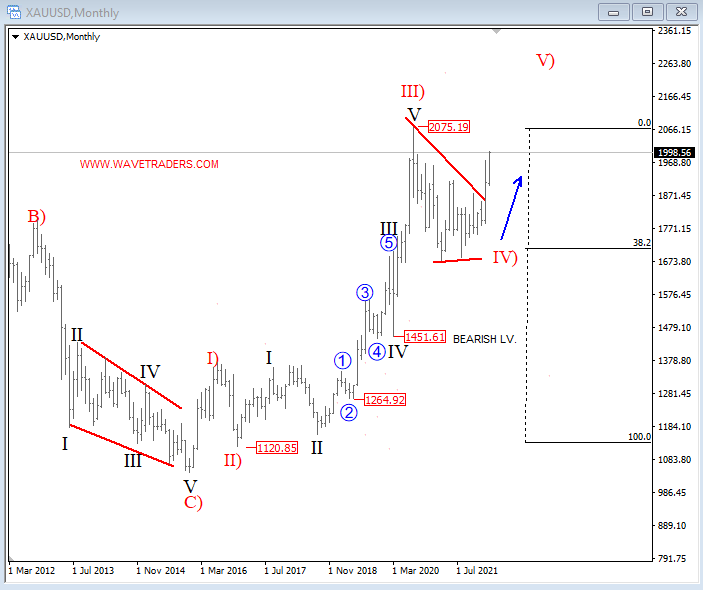

Definitely not an easy situation for investors, so we will most likely continue to see run to safety, which is Gold and USD at the moment. From an EW perspective we see metals coming higher, with gold breaking out of a triangle and hunting new ATH. Some wonder if higher rates can stop gold rise. I think maybe only temporary if FED surprises and hikes well above expectations, and if situation in Ukraine gets better. Ideally, this will be after fifth.