American exceptionalism] is a reaction to the inability of people to understand global complexity or important issues like American energy dependency. Therefore, they search for simplistic sources of comfort and clarity. And the people that they are now selecting to be, so to speak, the spokespersons of their anxieties are, in most cases, stunningly ignorant.

Zbigniew Brzezinski

Oil: Is the “reverse retail” trap about to be sprung again?

We can’t help thinking about how Mr. Market so often acts as a “reverse retail” machine. Despite the ongoing industry of Wall Street Analysts, pumping out reams of fundamental research supporting the case for mostly buying, and rarely selling, stocks, bonds, and commodities, the net effect lulls many traders into the view if prices are going up, it’s time to buy.

This action by Mr. Investor is the exact opposite of the rationale man who throughout his life shops for life’s essentials and is attracted by lower prices. The Mr. Investor mentality of “reverse retailing” has a long history on the Street.

The man who was considered among the greatest Wall Street traders was none other than Jesse Livermore. His advice, according to the scribes, was this:

Buy high and sell higher!

As great as Jesse was, and as pithy as the many phrases associate to him are, let us keep in mind he went bankrupt three times during his illustrious career. Finally ending it by blowing his brains onto the floor of the cloak room of the Sherry-Netherland Hotel in New York City.

So, we keep thinking of the “reverse retailing” trap likely to snare many oil traders and investors. This phrase comes to mind:

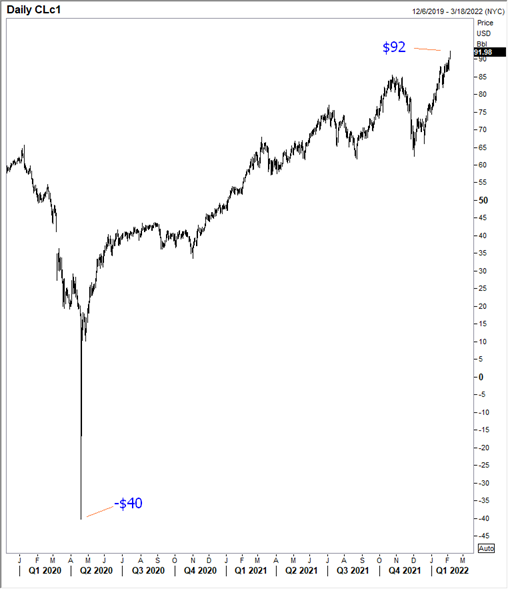

If you didn’t like it at negative $40 per barrel, you’re gonna love it at $92…

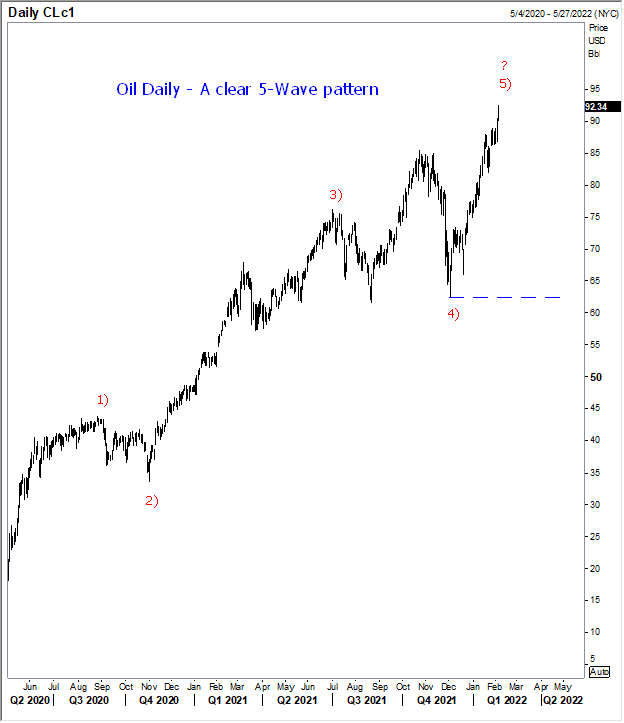

Crude Oil Futures (WTI) Daily Continuous Contract:

Despite the fantasy of renewable energy replacing oil and gas, it is unlikely that will happen anytime soon.

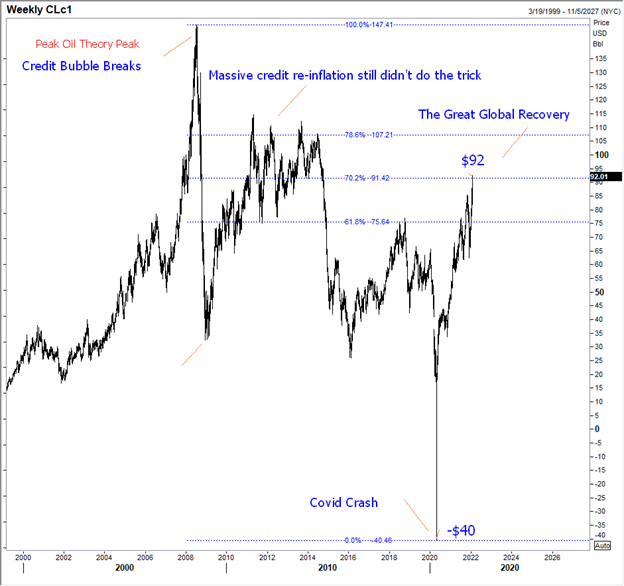

If you remember, during the last major bubble in asset prices; aka the “global credit crunch” triggered by the same old gang—central banks, governments, and Wall Street—there were reams of research telling us that oil at $147 a barrel was down-right cheap. That view was supported by the fantasy of “Peak Oil.” Peak Oil Theory in a nutshell said the available supply of available drillable supply was dwindling, therefore oil prices would continue to soar. It of course was a massive canard when supply was the consideration, an activity called fracking changed the game. This canard was supported by several Wall Street analysts and almost every Kook-Burger investment newsletter out there at the time.

If you were an unfortunate victim buying into the “Peak Oil” fantasy, and bought at the top, you only have about $155 per barrel to get back to break-even on the trade.

Below is a weekly chart of crude oil futures with some of our comments attached.

We could prattle on till the cows come home regarding the ineptness of government policies on oil and energy. Which have become especially insane due to the worship of “climate change.” But we won’t bore you.

But keep in mind, despite how “principled” a politicians stand on an issue may be, said pol will never let the chances of not being re-elected impinge his deep and abiding beliefs. And with energy prices soaring throughout the globe, voters (the plebs) are starting to grumble. This may suggest a touch of sanity will likely return to government energy policy. Even if said sanity returns in the dead of night, while voters are asleep. The takeaway:

- Governments are likely quietly scrambling for good old dirty natural energy again.

- This, over time, will likely increase supply.

- Thinking, some of those nasty pipelines blotting the landscape, will be approved.

- Some of those offshore drilling leases canceled will be reconsidered.

- More behind-the-scenes pressure will be applied to OPEC.

- And quite possibly, the insanity of US-policy of poking the Russian Bear in an effort to create chaos in the region (The Grand Chessboard strategy of Zbigniew Brzezinski), will be mollified, at least near-term. This is the wild-card for sure.

- Lest we forget; the most important driver of energy prices is the same as other asset prices—money!

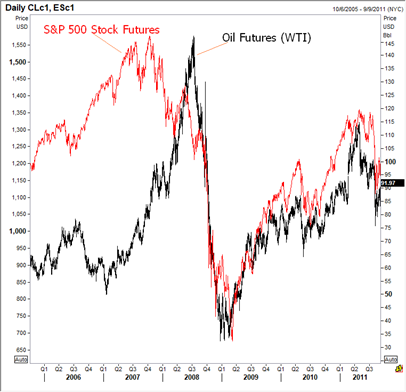

If the stock market stages a real correction, or crash, similar to what we saw during the 2007-2008 credit crunch, oil prices will follow. And given the new central bank fight against inflation, which is starting to look a lot like panic. 50 basis point hikes could be coming soon from the Fed and others. This increases the probability of CB overshoot creating a bust; as is the lesson of history.

Below a daily chart showing the path of oil prices and the US stock market during the 2007-2008 credit crunch.

And from an Elliott Wave perspective, there is a clear five wave rally pattern in play. It suggests a decent correction, or something more, soon. We are just waiting for a near-term reversal pattern to add validation for bearish look.

Oil is moving higher, diverging further from stocks near-term, on the blow-out (relative to consensus) January US Non-farm Payroll number released today. Are we going to see a demand surge from what many are now labelling a rip-roaring job market? Maybe. But we remain skeptical.

Overtime, the winning strategy for profitability and capital preservation can be summed up as: When everybody loves an asset class, it usually means it is time to start looking in the other direction to see if something clicks. This advice is the best single way of avoiding the being caught up in the “reverse retail” trap.

If you like what you see here, and would like our Macro Views sent directly to your mailbox, free, just click on link below and register.

Register for EW-Forecast Macro Views

Regards,

Gregor and Team…