Hey traders! We can see some strong riks-off since the start of the year based on speculation of hawkish FOCM policy with higher rates this year. Acceleration lower occurred due to US-Russian tension so investors are looking for safety, hedging their equity investments by buying puts. So far, puts are not at the extremes yet so there is room for more weakness on SP500 it seems. First nice support at around 4270/4300. In the meantime USD may see more upside.

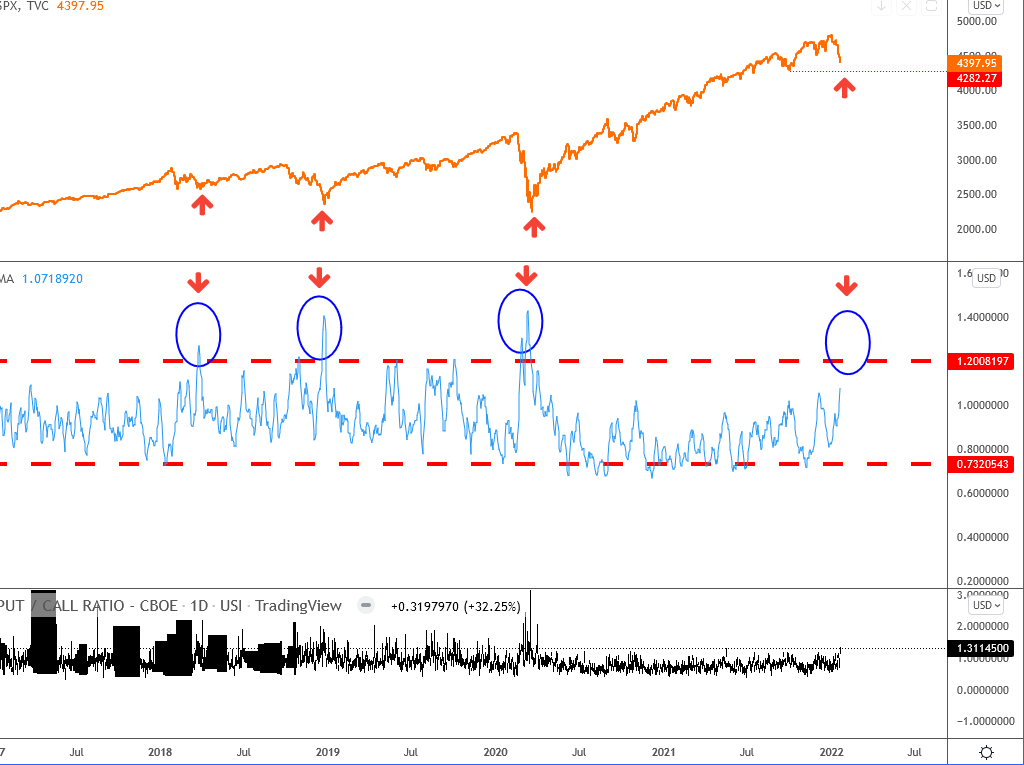

PCC vs SP500

In blue its MA (5 period) of put/call ratio. The average reading of put/call ratio data suggests that’s not an extreme reading yet, compared to the previous three cycles.