Since Gold has been in raging bull market, we have been excessively updating it on daily basis as the most interest is still there. We offer you guys today a flashback article, where the analysis go back to 15th of January, literally 7 days ago – where we have been anticipating a flush of bulls before continuing higher. Let’s see what we told our members that day:

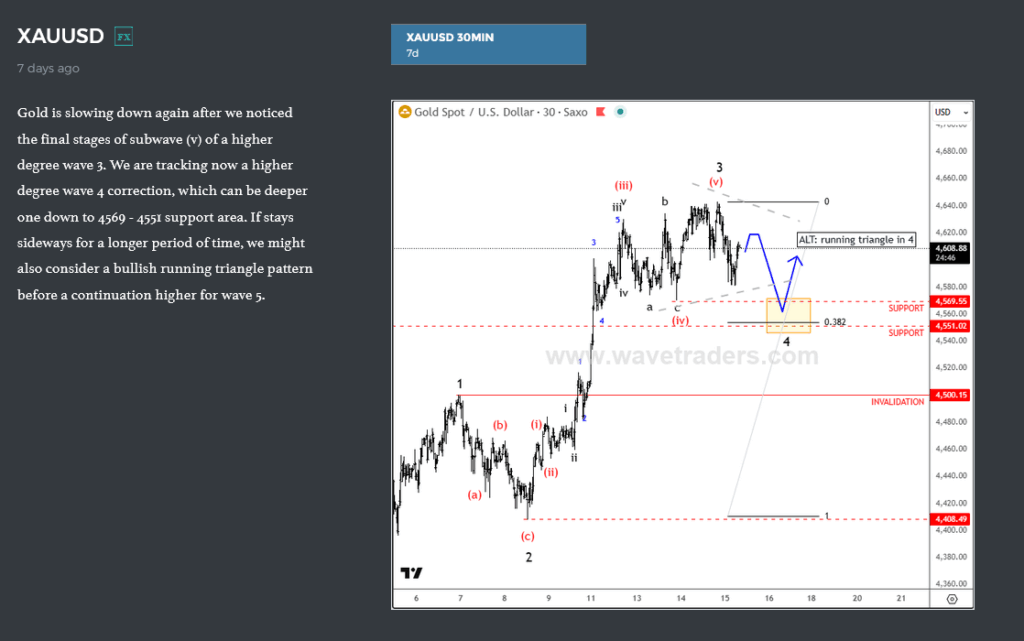

“Gold is slowing down again after we noticed the final stages of subwave (v) of a higher degree wave 3. We are tracking now a higher degree wave 4 correction, which can be deeper one down to 4569 – 4551 support area. If stays sideways for a longer period of time, we might also consider a bullish running triangle pattern before a continuation higher for wave 5”

Couple days later, 2 days ago, 20th of January, we have sent out another update that has been spot on with market expectations. And this is what we said after Gold met our expectations.

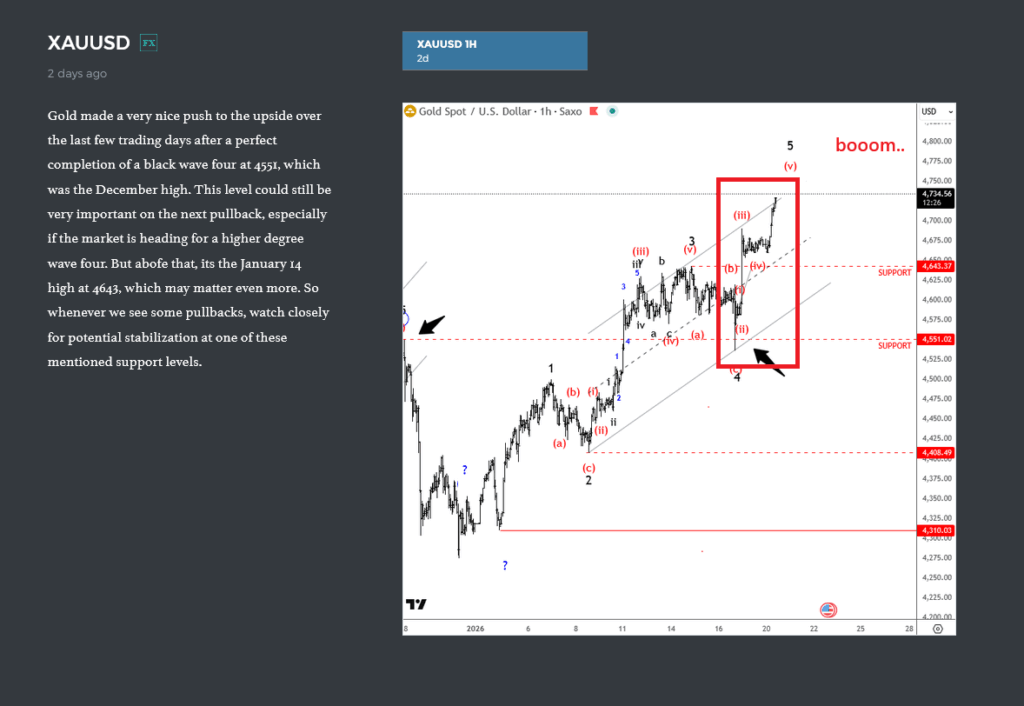

“Gold made a very nice push to the upside over the last few trading days after a perfect completion of a black wave four at 4551, which was the December high. This level could still be very important on the next pullback, especially if the market is heading for a higher degree wave four. But above that, its the January 14 high at 4643, which may matter even more. So whenever we see some pullbacks, watch closely for potential stabilization at one of these mentioned support levels”

To wrap it up, this move in Gold is a good reminder of why structure and levels always come first. When a market is trending, corrections are not a reason to panic, they are part of the process. The reaction from the 4569–4551 area was not random, it was a former high and a logical wave four support. As long as price holds above these levels, the bigger picture remains bullish and pullbacks should be treated as opportunities, not trend changes.

For more analysis like this explore our premium services.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.