Bitcoin has been trading lower since October 2025, and we have been talking about that important reversal on cryptocurrencies months ago. That move marked the late stages of a higher degree bull cycle, and since then we have been seeing lower highs and lower swing lows, without any serious overlaps, which suggests the trend is still bearish. What is also important is that the recovery from the November lows unfolded only in three waves, which points to a wave four correction that likely stalled between the 38 and 50% retracement. This is a very typical area for wave four to complete a countertrend move. The confirmation for continuation would come with a break of the corrective channel, which in our case could happen around the 88k area in the coming days. If that happens, then Bitcoin could see further weakness, potentially even toward the 74k area in the next few weeks.

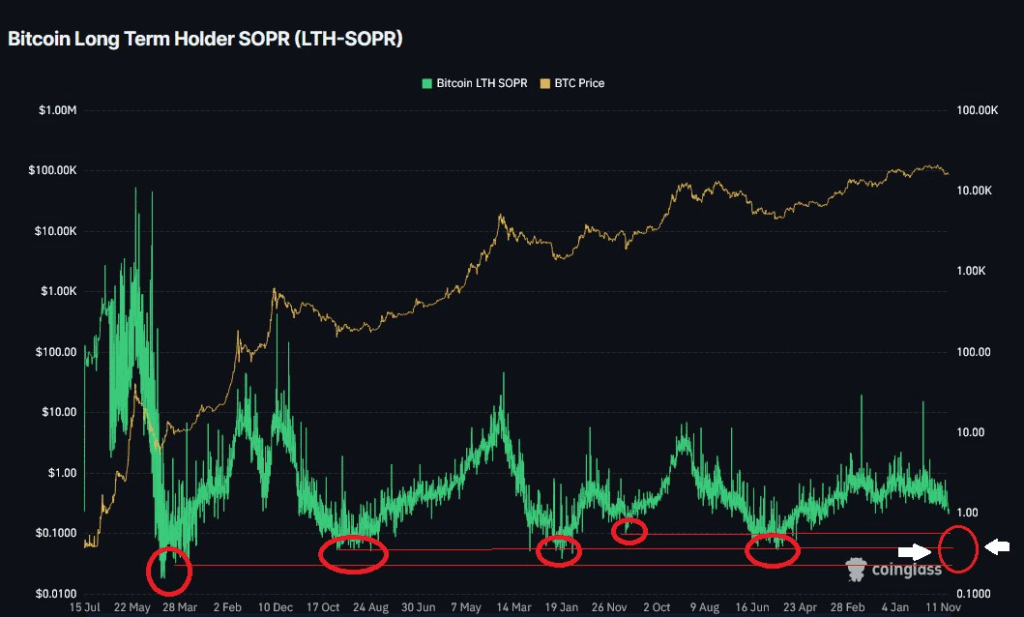

When looking at long term Bitcoin holders, they are still not at the losses like we have seen in past cycles such as 2012, 2015, 2019, or even 2022. This suggests there are still plenty of holders who are not concerned about the downside risk. But ff we see another push lower, it could trigger more liquidations and lead to an extreme level of pessimism. In Elliott wave terms, that is exactly what you want to see in a wave five, as this is where meaningful bottoms tend to form.

NEW US Single Stocks Service (And Its Free!!)

Get Elliott Wave US Single Stock Report for some big names and companies