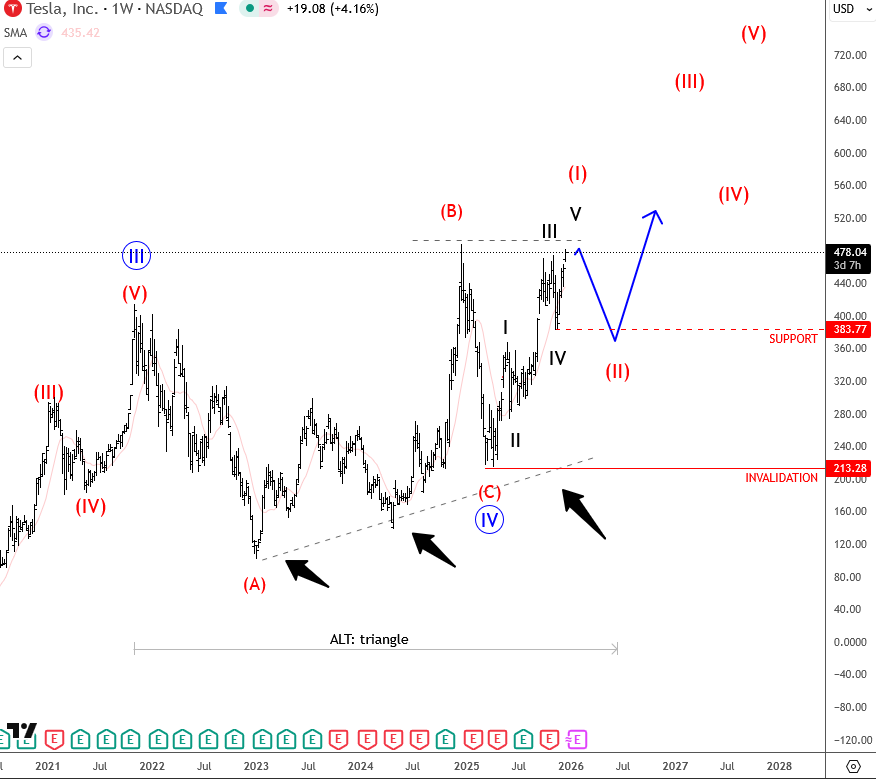

Tesla has been on the rise since March this year and is now approaching some very important levels around 480, which marks the high from about a year ago. What really matters at this stage is that we have five waves up from 217, which is a very strong bullish structure and suggests more upside ahead, as the market is showing a progressive trend. Because of that, there could be interesting opportunities to join the trend, especially if we see some kind of retracement in 2026. In that case it makes sense to keep an eye on the previous lower-degree wave four support around 483, which could be an attractive area for the next rebound.

An alternate wave count also allows for a triangle to form here, which would again suggest that after a setback into wave E of four we would most likely see more upside. That scenario would remain valid as long as the December 2024 highs are not breached. In general, the best opportunities could show up if we get a retracement into a lower-degree wave two and then look to ride the next strong leg higher, while the market holds above 213.

GH

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.