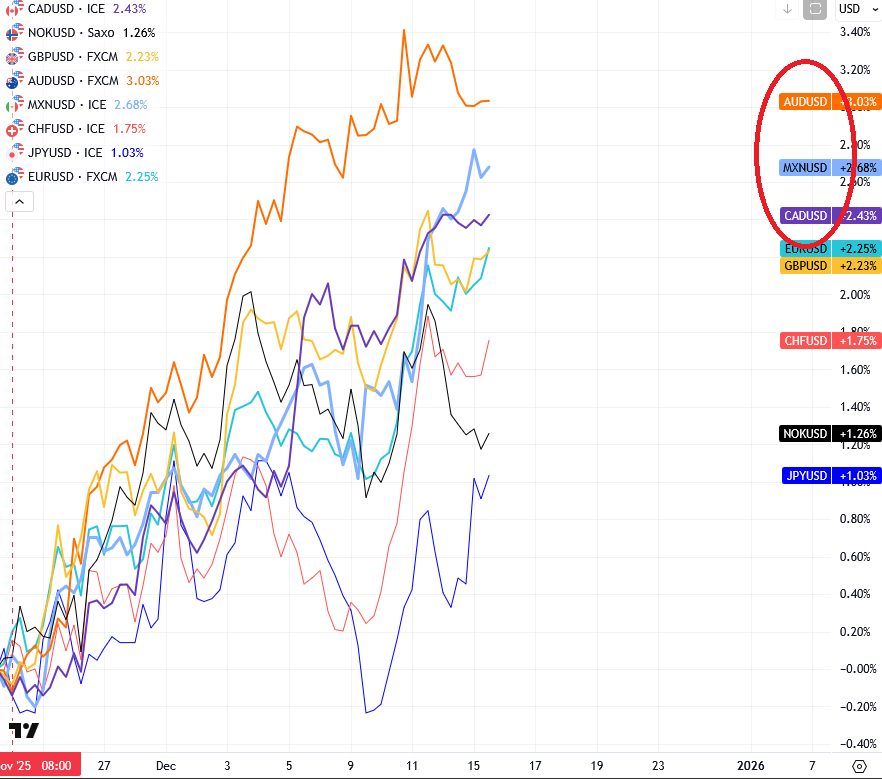

As you know, with the recent stock market rebound we are seeing commodity currencies doing very well, much better compared to euro or pound. Several central banks, such as the Bank of New Zealand and the Bank of Canada, have recently highlighted that they may be done with cutting rates, as their economies have been performing better than initially expected. This was also noted in recent statements from the Bank of Canada, so it is not a surprise to see USDCAD coming to the downside quite aggressively over the last few weeks.

If we look at the wave structure, we can clearly see a clean breakdown through key trend lines and swing supports, which in my opinion is a strong indication that we are in a new bearish phase. The decline also shows extended characteristics, and extended legs usually appear in wave three. Right now it looks like we are at or near the end of wave three, trading close to the previous 1.3727 support area, around the 261.8% extension. This is the zone where we could see some slowdown and possibly a wave four rally.

If someone is looking to join the broader downtrend, it makes sense to watch the previous fourth wave levels and the former broken swing support around 1.3870 to 1.3880, as that zone could be interesting for renewed weakness. Invalidation remains at 1.3972. As long as this level holds, the broader downtrend can resume.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.