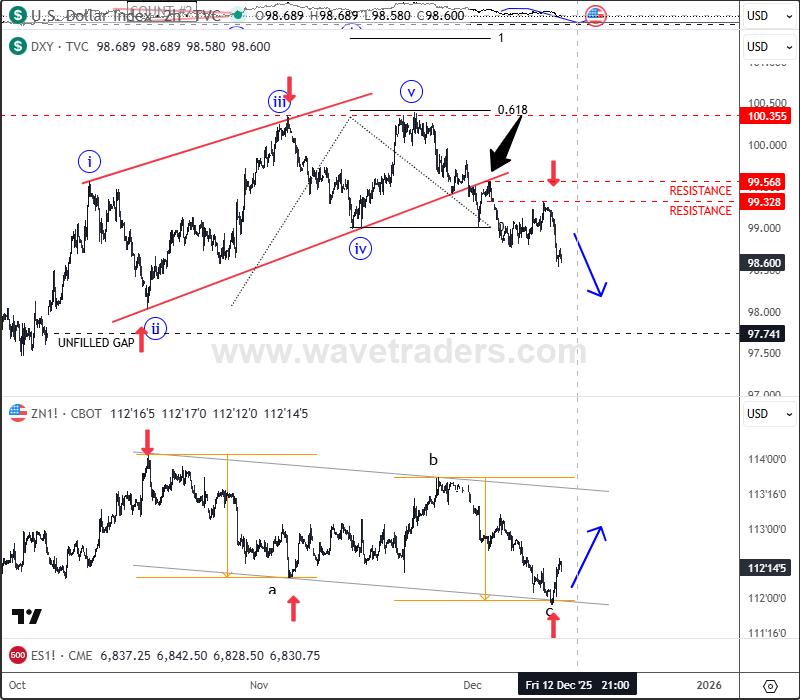

The Fed cut interest rates by 0.25% yesterday, marking the third straight cut. A few members dissented, showing the committee isn’t fully aligned. They proceeded with the cut as the job market continues to cool, even though inflation is still sticking around. The Fed also hinted this could be the last cut for a while and announced plans to start buying short-term Treasuries to keep liquidity stable. The US dollar remains under bearish pressure, while stocks hold steady, keeping the risk-on sentiment intact. This momentum could carry into year-end, we should just be aware of potential short-term pullbacks. USDollar Index – DXY remains nicely bearish, supported by 10Y US Treasury chart, as anticipated. If we consider that 10Y US Notes chart is now turning back to bullish mode, then DXY could easily see more weakness at least towards the open/unfilled GAP at 97.74 area.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.