Apple (AAPL) remains one of the world’s most valuable companies, driven by strong iPhone sales, a growing services segment, and consistent innovation in hardware and software.

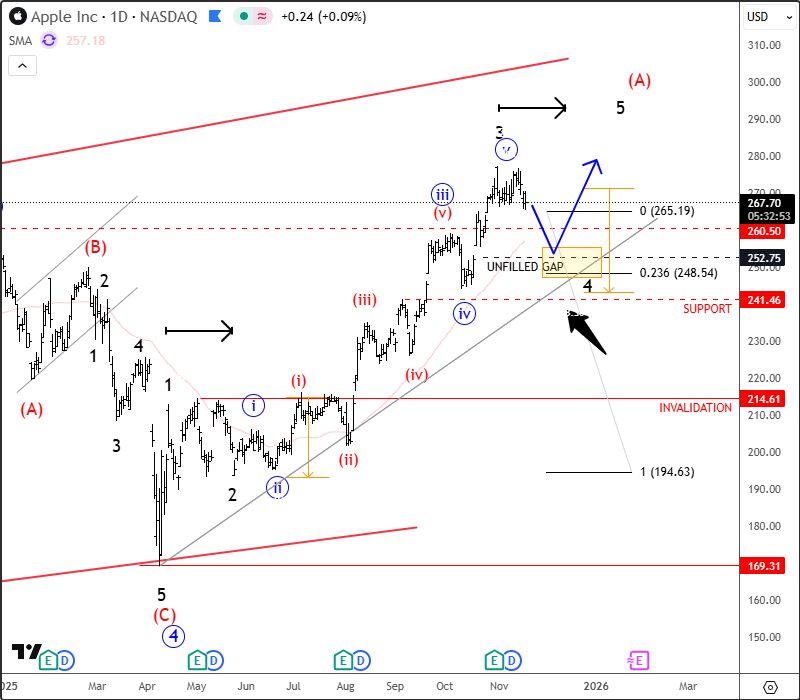

We shared Apple already back on October 16, where we talked about it’s on the way back to all-time highs within an impulsive five-wave rally. CLICK HERE

As you can see by today, Apple hit all-time highs, but an uptrend may not be over yet. Infact price is showing a clear impulsive structure that still supports the broader uptrend. However, it looks like black wave three on the daily chart may be finshed, so a near-term pullback would be natural and healthy before the next bullish leg shows up. Any deeper retracement could provide a new opportunity to join the trend IMO, with the previous fourth-wave zone around 244–251 offering an attractive support area while the market stays above 214, the key invalidation level. Also, notice that [b]252 is a gap[/b] from the latest earnings release, so it certainly can be an interesting zone for completion of a next retracement.

Highlights:

Trend: Bullish (wave three nearing completion)

Support: 244–251

Resistance: 300

Invalidation: 214

Note: Watch for more gains after wave 4, nice support at 252 gap

NEW US Single Stocks Service (And Its Free!!)

Get Elliott Wave US Single Stock Report for some big names and companies