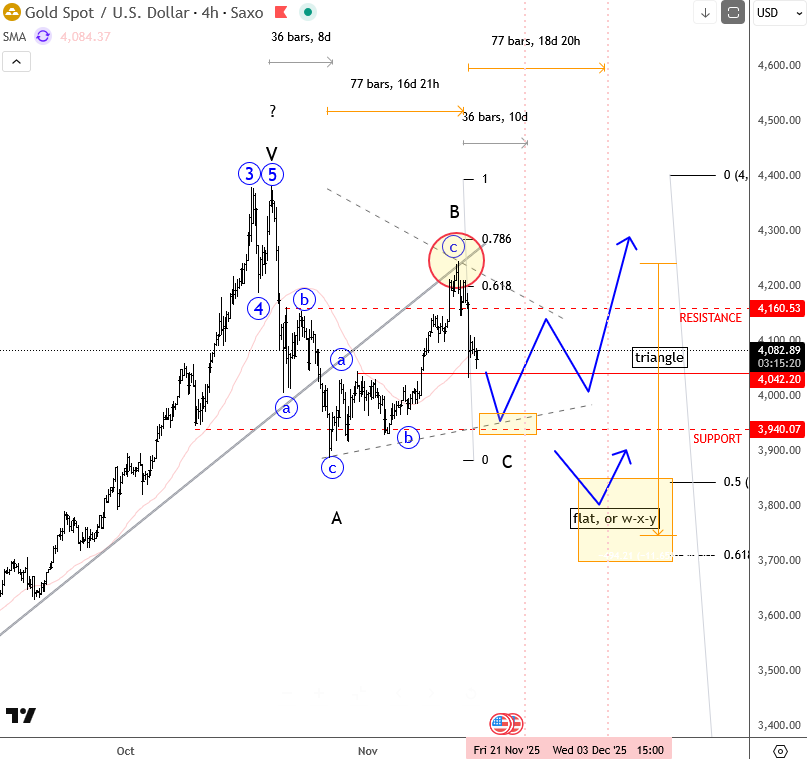

Gold turned sharply lower in October, pulling back around 10%, which is quite normal after such a strong and aggressive recovery this year. The key question now is whether this is now wave four of an ongoing extended black wave five cycle, or if wave five already completed leg out of triangle, at the 4380 area !?

Well, notice that Gold turned lower at the end of last week from the trendline resistance after only an ABC rise into the 61.8–78.6% Fibonacci zone, and the market then dropped enough to overlap the 4042 level. This makes me think we are in the middle of a complex correction.

It can be a triangle, it can be a flat, it can even be a WXY formation, so overall it looks like metals will stay inside this correction for a bit longer.

There is also a risk that lower supports will be retested first. The first important support is around 3940, but if that one gives way then the next bigger zone is down at 3700–3800. So, ff we are correct, metals will still resume higher later on, but right now we are still stuck inside this corrective phase, so it’s better to stay patient.

GH

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.