McDonald’s (MCD) is one of the world’s largest and most recognizable fast-food chains, founded in 1940 in San Bernardino, California. It’s best known for its burgers, fries, and quick service, with its signature item being the Big Mac. Today, McDonald’s operates in over 100 countries, serving millions of customers daily and continuously adapting its menu to local tastes and global trends.

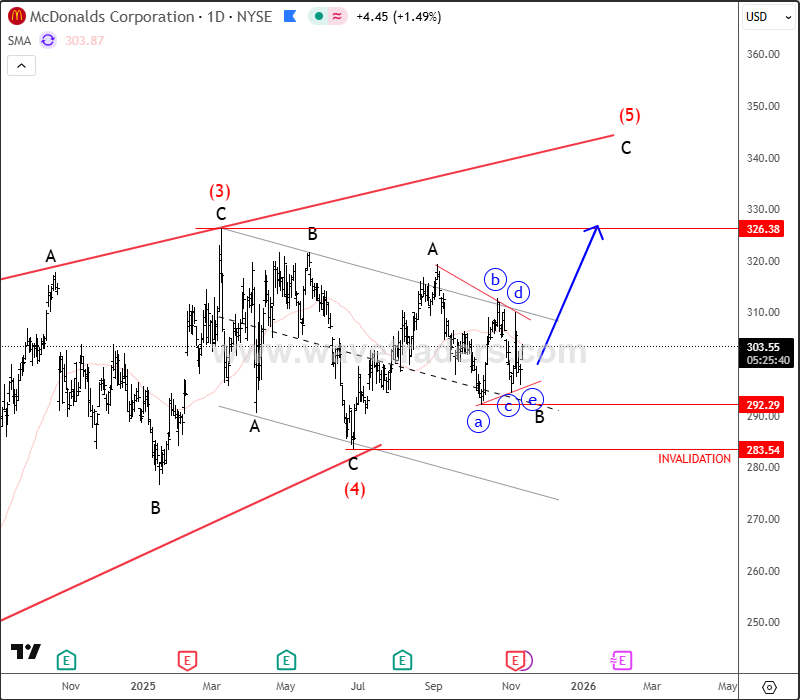

We talked about McDonald’s back on September 02, where we mentioned and highlighted that it’s trading in the final 5th wave of the wedge pattern, which is actually still in play. CLICK HERE

McDonald’s is forming a potential wedge pattern, also known as a diagonal, which can often cause a strong reversal — but path is not complete yet. Ideally, we’re missing one more push to new highs, as the daily chart suggests wave four ended at 283, followed by a strong rebound to the upper side of the channel, likely wave A of a developing wave five. So, after the latest bounce from the lower trendline support, the market could poised for another move higher, after a triangle in B wave. However, once new highs are reached, we’ll need to be cautious, as the bull cycle could be approaching its end.

Highlights:

Trend: Bullish break expected after B triangle, for ATH (wave five diagonal)

Support: 300, 292,

Resistance: 326

Note: Final leg higher before potential reversal

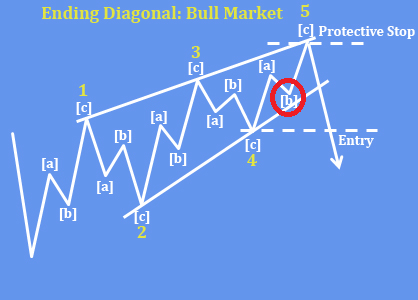

The basic ending diagonal (wedge) pattern suggests that the final subwave (c) of wave 5 may still be missing before the completion of the top formation. This implies that the market could experience one last push higher to finalize the structure before a potential reversal occurs.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.