Per our latest update on Forex pair USDCHF – we spotted that the current bounce could be a suckers rally inside zigzag pattern for wave B. Here is the snippet from our update.

USDCHF has made a nice and interesting recovery since September, but so far only in three waves, with a recent reversal down from around the 0.8070 area, so recovery might have been just another corrective rally within an incomplete downtrend. As we know, if we don’t see five waves up from the lows, then the bottom is likely not in place yet. In fact, if current prices break the channel support and move through 0.7940, we should be aware of a possible retest of the 2025 lows, which could be the final leg within a higher-degree ending diagonal. Also keep in mind that USDCHF could still move lower even in a risk-off mode, as the Swiss franc tends to act as a safe haven in times of uncertainty. However, if we see a sudden and very strong franc in the weeks ahead, the Swiss National Bank could step in and take action to prevent it from rising too far, as they already expressed some concern about that in recent statements.

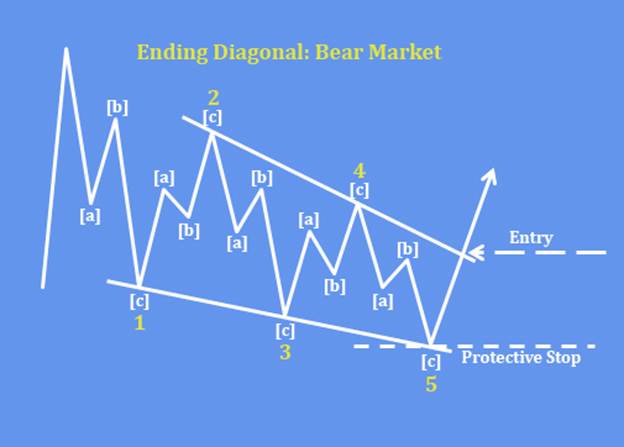

Ending Diagonal

An ending diagonal is a wedge-shaped 5-wave pattern (1–2–3–4–5) appearing in wave 5 or C, signaling trend exhaustion, as price is struggling to resume lower.

Each wave subdivides into three smaller waves, with wave one and four overlaps as momentum fades.

It often ends with a sharp breakout in the opposite direction.

Elliott Wave School

Video lessons about the Elliott Wave theory. Access to more than 7 hours of educational material

GIFT: one month free access to our premium services)