Johnson & Johnson’s (JNJ) stock is trading higher thanks to stronger-than-expected earnings, raised full-year guidance, and continued growth in its MedTech and pharmaceutical divisions. Recent acquisitions and drug pipeline successes (like its promising psoriasis treatment) add to investor optimism, while its consistent dividend increases and defensive healthcare profile make it attractive in a volatile market.

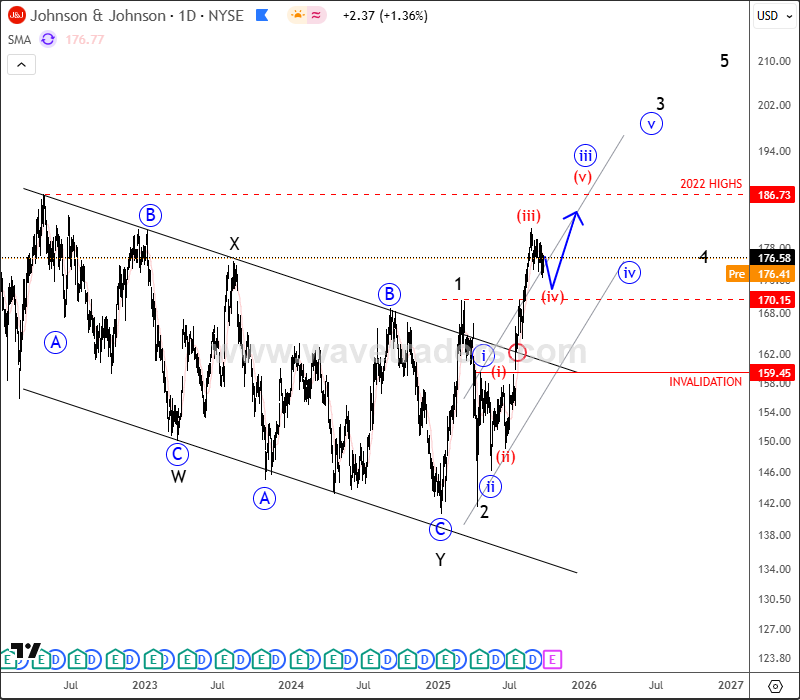

Johnson & Johnson (JNJ) made a strong and aggressive breakout of the corrective channel back in July, so from Elliott wave perspective, we see this as a new bullish trend that could take us back to the 2022 highs, until it fully completes a five-wave bullish cycle of different degrees. After the current retracement, there is nice potential support for wave four around the 170 zone, while the invalidation level remains at 159. Watch for a fifth-wave recovery setup with a target closer to 186.

Highlights:

Trend: Bullish continuation (after wave four)

Support: 170

Invalidation: 159

Target: 186

NEW US Single Stocks Service (And Its Free!!)

Get Elliott Wave US Single Stock Report for some big names and companies