Markets are consolidating after the first sell-off at the end of September ahead of the US Labor holiday. Stocks have stabilized a bit, but they are not really resuming higher, as many investors remain on the sidelines waiting for tomorrow’s US NFP report. This will be key data for new positioning in investor portfolios, especially since Powell hinted they could be looking to cut rates. If that view is confirmed and jobs data comes in weak, then after some initial volatility, we could see stabilization.

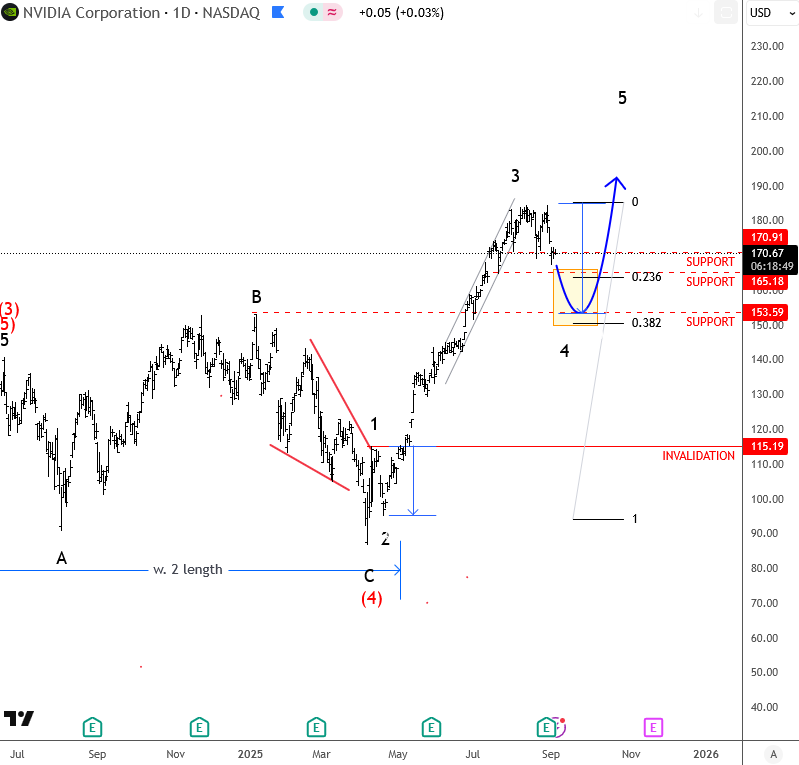

Last week I looked at Nvidia and noted that the stock was in an ongoing correction, with the question being whether it would get deeper. Earnings were positive, but some expected a bit stronger, so consolidation is still ongoing. What we see now looks like wave four, with price currently testing the 170 support. The deeper and more important level is around 150, which also lines up with the 38.2% retracement and the previous highs near 153. In my opinion, the 150–170 zone is quite attractive for a potential rebound.

For more updates on US single stocks, make sure to check our online section and register for free, as the service is still in beta and traders can download the US single stocks report absolutely free. www.wavetraders.com

Grega

For constant and free access to our US stock coverage, make sure to register and apply for access.

5th report is already available >> https://wavetraders.com/elliott-wave-plans/

NEW US Single Stocks Service (And Its Free!!)

Get Elliott Wave US Single Stock Report for some big names and companies