US and China seem to be agreeing to cool down trade tensions, but so far we’re not seeing much of a real move on the markets. Most likely, traders are staying on the sidelines ahead of the key US CPI figures, which will be released today at 14:30 CET. Inflation is expected at 2.5%, up from 2.3%.

Now, what’s important here is that if inflation really ticks up, this could be positive for the US dollar and US yields, short-term. One of the key indicators for inflation expectations is energy, and if you take a look at crude oil, it’s been trending higher through May—so maybe that’s a clue that CPI could indeed come out at or even above 2.5%.

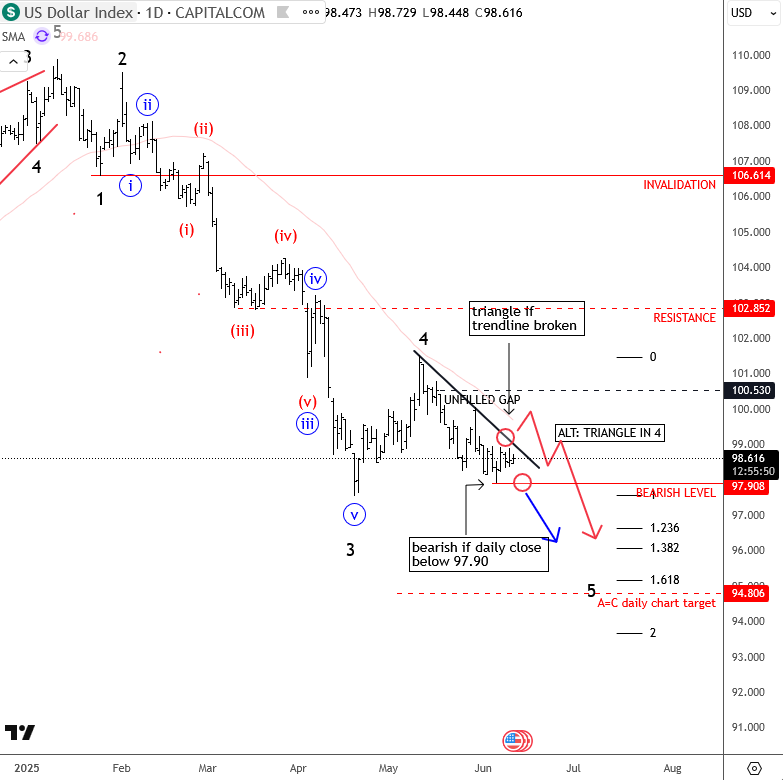

If that’s the case, the Fed may have another reason to stay on hold. In the short term, the dollar index might consolidate a bit longer then, maybe even back up to around the May 29th swing high, which is an important resistance zone. But still, be aware of a possible immediate decline into a fifth wave if 97.90 support gives way, which sooner or later will happen because move from April low is corrective.

GH

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.