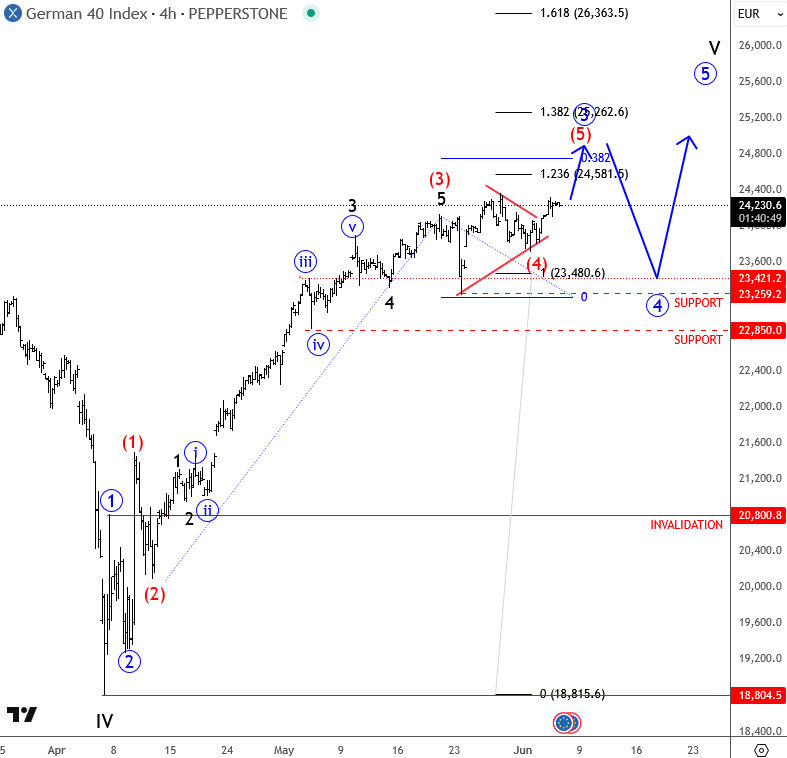

At the start of April DAX made a very sharp and aggressive drop triggered by the tariff announcements from the US, which we saw it as a higher degree wave IV correction on a daily chart. But with Trump putting some of the tariffs on pause, also one recently imposed for the EU, and speculation that they will reach a trade deal with other countries, is causing a sharp rebound. It’s already back to all-time highs for wave V with space up to 25k-26k area this year.

It’s an impulsive five-wave recovery underway in the 4-hour time frame, which can be ready to resume soon, as wave (4) triangle correction can be coming to an end. As such, be aware a bullish continuation within wave (5) of 3 towards 24500 – 25000 area. If we see a bigger decline, then it can also be in a higher degree blue wave 4 correction with the support around 23000 area.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.