EURUSD moved nicely higher in April, into the 1.15–1.16 area, a resistance where pair slowed down at the end of wave 3, which puts new retracement in play. However, a pullback is now in three waves, so it’s seen as temporary within the broader uptrend. We see some deeper retracement but still at key levels here at 1.11, near the 38.2% Fib. Slightly lower we have 1.09. So current pullback is seen as wave 4 that belongs to an uptrend, which can send prices higher, with a reversal in view already this week. Break above 1.3 makes further room for wave 5.

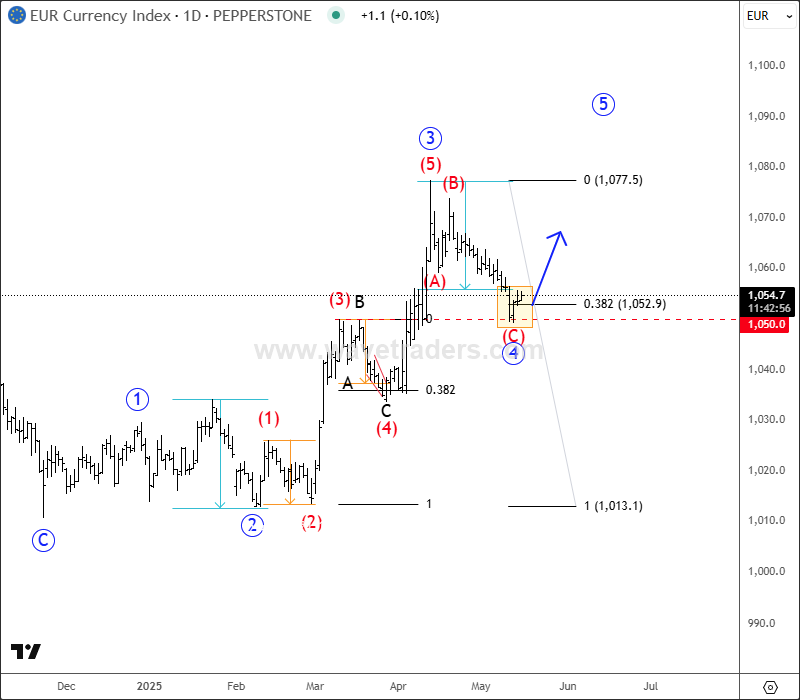

The reason for higher EURUSD is not only weak USDollar, but also trong EUR currency. EUR Index chart with ticker EURX can be also finishing an ABC correction in wave 4, right at the former wave (3) swing high and 38,2% Fibonacci retracement, which is ideal support for wave 4, from where we may see a bullish resumption within 5th wave.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.