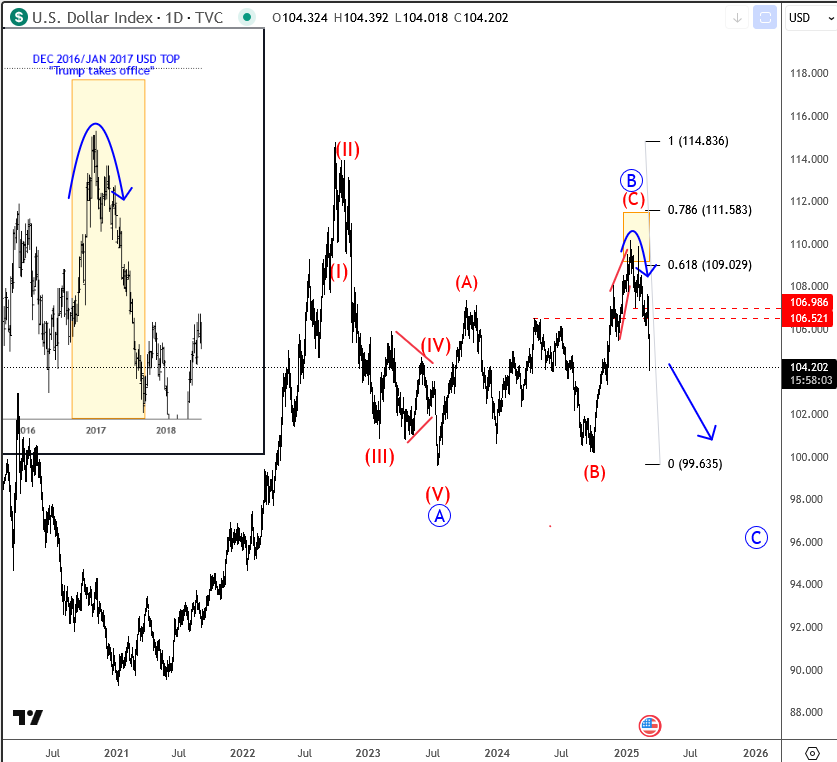

USDollar Index – DXY is moving as anticipated from technical and Elliott wave perspective since the start of 2025 and we have been talking a lot in the past months.

On January 03, we warned about a strong resistance for wave (C) of an (A)(B)(C) correction in wave B that can cause a reversal down for wave C in 2025.

Later on February 25, we got that reversal from projected resistance after a completed wedge pattern within wave (C) of B, so we pointed out that much more weakness is coming for a higher degree wave C.

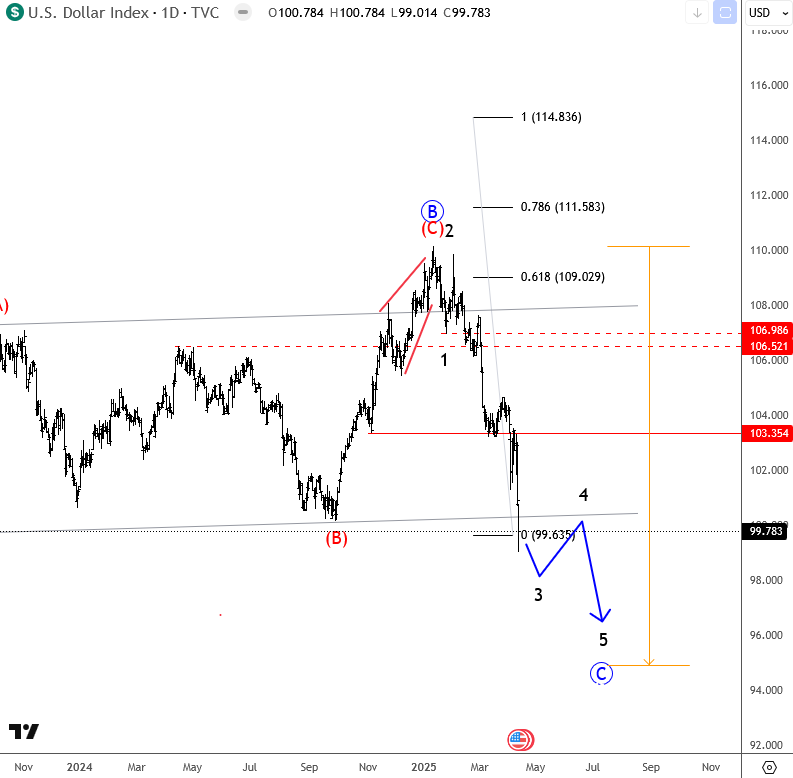

On March 06, it extended strongly lower, similar to back in 2017, when Trump also took office like this year, so wave C was in full progress and barely in the middle of an impulsive decline towards 2023 lows.

As you can see now, in April, DXY is already back to 2023 lows and below 100 area for wave C as expected, but due to an unfinished lower degree five-wave bearish impulse, there can be room down to around 94 area, so after subwave 4 pullback, we may see moore weakness for subwave 5 of C.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.