Hello Crypto traders!

Ethereum with ticker ETHUSD is consolidating, looking like a triangle on a weekly chart that can be finished, so sooner or later the coin will be expected to resume higher, but ideally after a pullback in wave 2 on a daily chart.

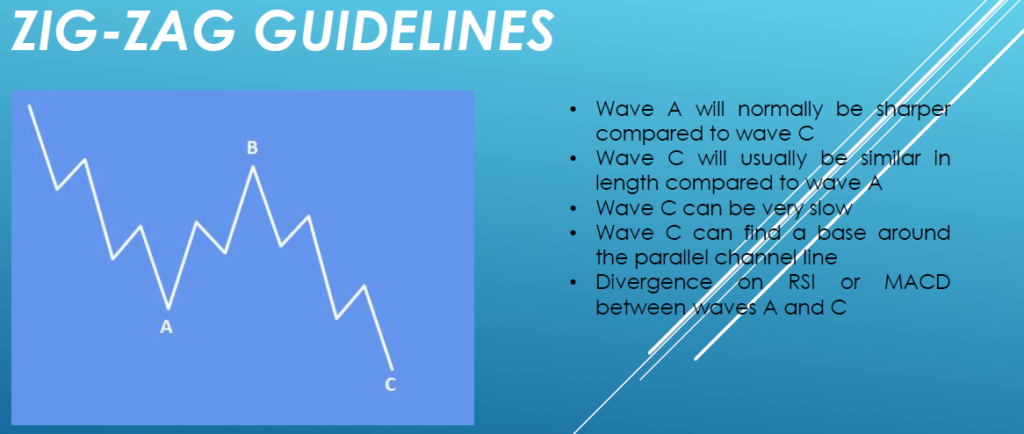

In the 4-hour chart we can see a new sell-off after a three-wave corrective rally only, so correction can be still in progress as a deeper ABC correction, where wave C can now revisit 2800 support area before bulls show up again.

In Elliott Wave Theory, a zig-zag correction is a type of corrective wave pattern that typically unfolds in a three-wave structure labeled A-B-C. This pattern is characterized by its sharp and deep retracement against the prevailing trend. The first wave A moves in the direction opposite to the main trend. The second wave B retraces a portion of Wave A but does not go beyond its starting point. The third wave C moves in the same direction as Wave A and often extends beyond its end, completing the correction.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.