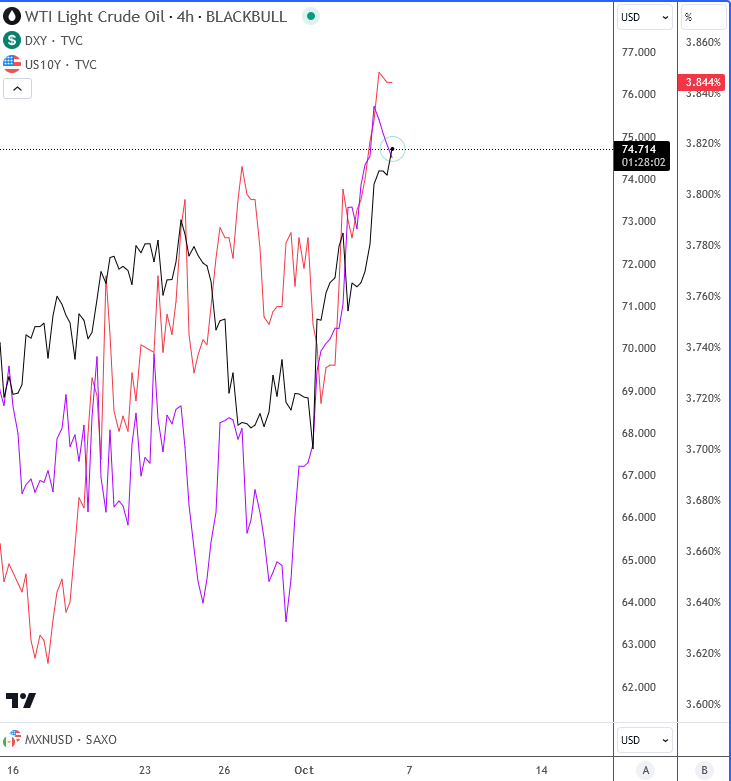

Welcome to an important day as we await the US jobs report, which is crucial for the Fed’s next policy decisions. Logic is simple; if the data comes in worse than expected, the Fed may consider more rate cuts. However, if the jobs data is strong, it could reduce the likelihood of further cuts. In addition, the escalating conflict in the Middle East is pushing crude oil above $74, while investors and traders seek safety, dollar is higher as well as metals. Its important to note that higher crude already itslef signals for higher inflation, and if data will be strong, rate cut may not be needed as much as speculators think. So, there is a possibility that after strong data, dollar will go much, much higher. Meanwhile, the stock market remains sideways, likely awaiting the release of the jobs report.

As for the US yileds, we are still seeing an ongoing recovery that appears incomplete, it looks like wave four with room for 4%.

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.