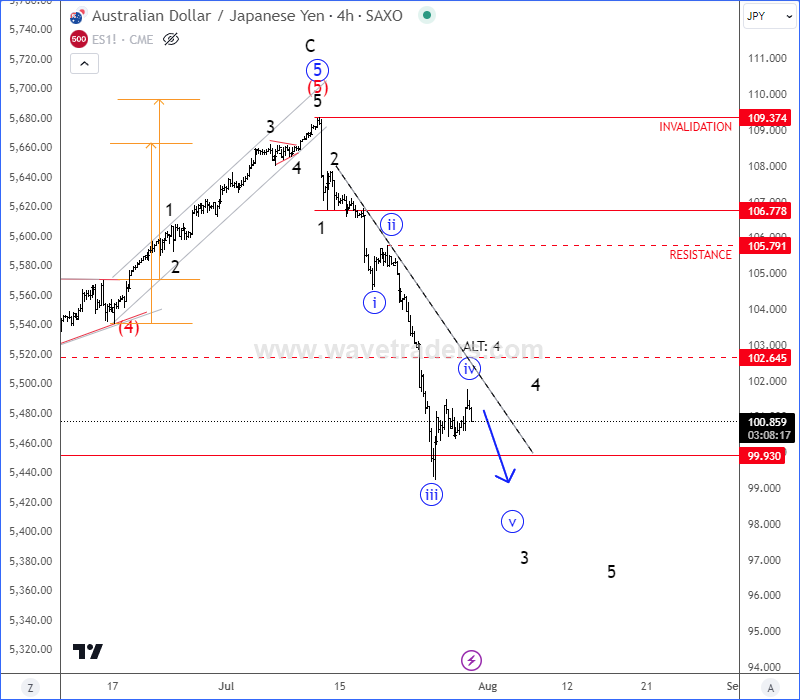

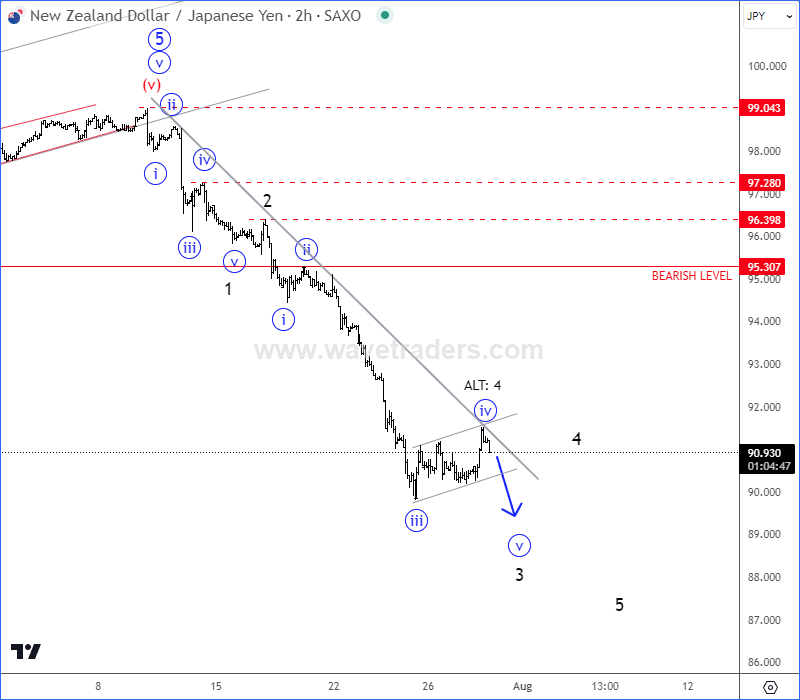

XXXJPY Japanese Yen crosses are turning strongly down from the highs after another BoJ intervention. And, with bearish looking Yields, seems like Japanese Yen may face further recovery, which can push XXXJPY cross pairs even lower.

AUDJPY remains under bearish pressure in the 4-hour chart and it can be still falling in an impulsive five-wave fashion, so after current corrective recovery, which we see it as 4th wave, watch out on further weakness within the 5th wave.

NZDJPY made a nice intraday corrective pullback in the 2-hour chart, ideally for subwave »iv« or maybe even a higher degree black wave 4, so more downside pressure can be seen for the 5th wave.

All that being said, looks like XXXJPY crosses are turning bearish and we can expect even a higher degree bearish reversal, but as soon as five-wave decline is finished, there will be a higher degree corrective recovery that will take some time before bears will resume.

If you want to track XXXJPY crosses step by step, then you may want to become a member of www.wavetraders.com

Become a premium member

Get daily Elliott Wave updates for some major Digital currencies, FIAT currency markets, major stock indexes, gold, silver, crude etc. or apply for unlimited access to the Elliot Wave educational videos.