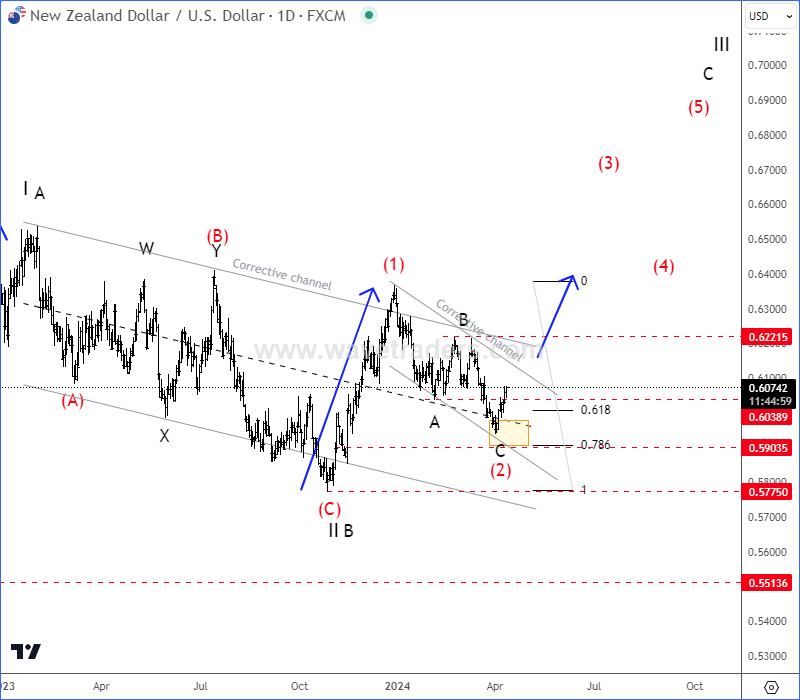

The Kiwi Is Finally On The Rise, as we see it turning sharply and impulsively up away from the support by Elliott wave theory.

The Kiwi with ticker NZDUSD is finally on the rise after we noticed an A-B-C corrective decline in wave (2) on a daily chart. We warned about that with an article shared on April 10. CLICK HERE

As you can see today on May 29, we can see price nicely bouncing and impulsively recovering, which can be signal that support is in place, especially after RBNZ hawkish shift. So, more upside can be seen within impulsive recovery, just be aware of short-term pullbacks. Alternatively, there’s also a chance for a bullish triangle pattern, but in both cases we expect higher prices at least up to 0.65 – 0.70 area or higher.

If you are interested in short-term counts and lower timeframe charts, then you may want to join us @ www.wavetraders.com

Become a premium member

Get daily Elliott Wave updates for US Single Stocks, SP500,DAX, GOLD, SILVER, CRUDE, FX, CRYPTO, etc. or apply for unlimited access to the Elliot Wave educational videos.

Decentraland a.k.a. MANAUSD May Have Formed A Bullish Setup. Check our free chart here.