I hope your Easter holiday was filled with joy. I had the pleasure of spending mine with my family, seizing the opportunity for some rejuvenating hikes.

Turning our attention to the financial markets, the USD has shown an uptick in value, with the DXY index surpassing its February highs, indicating a resurgence in dollar strength. This trend comes in the wake of the latest sessions, where both US treasuries and the S&P 500 experienced declines. A pivotal factor contributing to the dollar’s fortitude is the recent ISM US Manufacturing PMI report, which marked a return to expansion territory for the first time since November 2022, posting a figure of 50.3 against the anticipated 48.5.

This suggests that the US economy may be on a path to recovery, potentially maintaining current inflation rates for a duration exceeding the Federal Reserve’s projections and, consequently, postponing any anticipated rate cuts.

Nonetheless, the upcoming Non-Farm Payroll (NFP) data this Friday will be critical in assessing the true state of economic health.

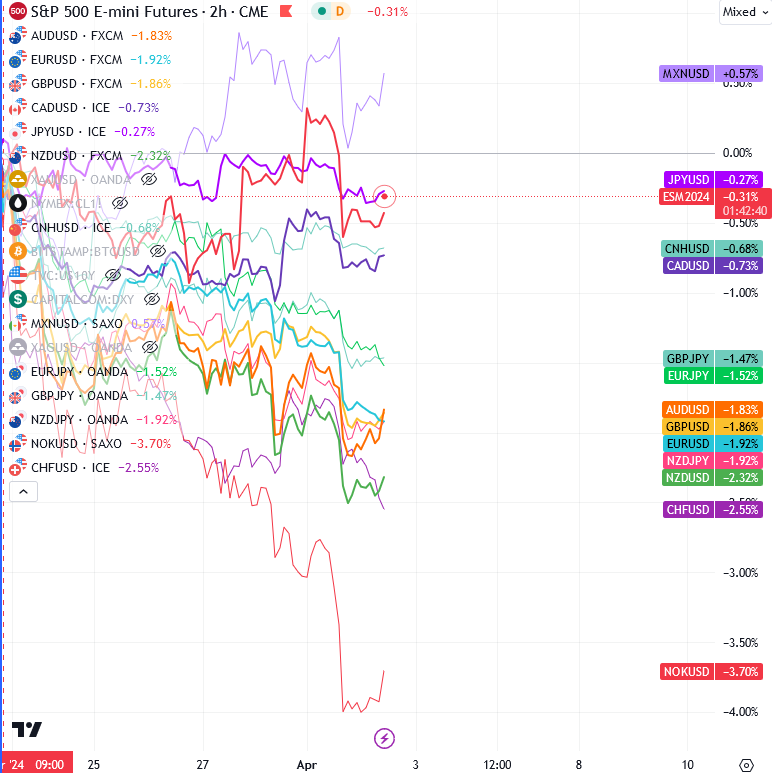

In the context of global central banks’ dovish stances since the Swiss National Bank’s rate cut on March 21, the Norwegian Krone (NOK) emerges as the weakest link, with the Swiss Franc (CHF), New Zealand Dollar (NZD), and Euro (EUR) trailing closely. This dynamic suggests that if the dollar continues its upward trajectory, these currencies merit close observation for potential movements and short opportunities vs USD, after pullback of course.

I will talk about this and more in our webinar later today at 15CET. HERE

Grega

US ISM M. PMI

FX correlations